Buying recommendations by Certified Origins

What’s happening this month?

The Olive Oil market remains tense: the low volumes expectations for the upcoming 22/23 harvest and rising energy costs are the two main points of concern for the whole sector.

The current market situation

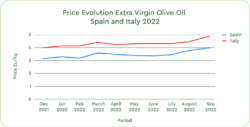

Extra virgin Olive Oil from Spain, the country responsible for approximately 50% of the global production, is currently valued at 4.15 Eu/kg at the source. This price is surprisingly very close to the cost of Refined Olive Oil from the exact origin, trading around 4.05 Eu/kg. Conventional Extra Virgin Olive Oil from Italy, often considered the most valued origin in the market, is currently trading at 5.10 E/kg.

Drought and harvest forecasts in the Mediterranean Area

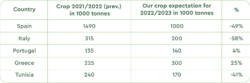

Farmers across Europe report large areas with olive trees with few or damaged olives, so some may decide not to invest resources in harvesting, expecting too little volume in return. The health of the olive trees has been affected mainly by an arid spring, right during the blooming period, followed by record-high temperatures in summer that continue to this day. As we wait for October for official data on harvest expectations, some experts in Spain fear a decline in national volumes as low as 50%, while Italy estimates a total drop of circa 55% compared to the previous year.

Specifically in Andalusia, Spain’s largest growing area, cooperatives of farmers are preparing for a harvest of only 700,000 Tons, a volume much lower than the 1,150,000 Tons collected last year. In Puglia, Italy’s most important growing region, located in the south part of the country, the situation looks similarly dramatic, with projected losses of around 50%.

Greece is going against the trend by showing exceptionally positive harvest expectations. Early projections place the coming harvest to reach 330,000 tons, a very high figure for a relatively small producing area, where the higher yield on records delivered 346,000 tons in 2017/2018. Similarly, Portugal Evoo and Olive oil outputs are expected to perform positively, with a harvest of 140,000 tons, similar to the crop 2021/2022.

Rising production costs

The harvest and production activities for 2022/2023 are about to begin. With the expectations of incredibly high energy bills and the increasing cost of packaging, many producers fear that the end cost will affect consumer trends, slowing down the consumption of the whole Olive Oil category.

Final Thoughts

Our teams of experts are traveling across the Mediterranean in this very delicate moment to talk to farmers and monitor the health of the olive groves. The weather in the coming weeks will be decisive for the final harvest expectations and the evolution of the market. By looking at the weather forecasts, the hopes for rain in Spain and Italy are few. What is already certain is that the next campaign will have many challenges to overcome. From today’s perspective, we believe the market will remain sustained for the coming months, as the complex panorama keeps the demand for Olive Oil high. Some prominent players with low reserves decided to anticipate their tenders for fear of higher costs in the coming months.

Please feel like always free to reach out to talk with your team of sales experts for any additional question or comment you may have.

Sources:

International Olive Council

El confidencial

Olive Oil times

Olimerca

Back to Learn & Discover Back to Market Reports