Olive Oil Monthly Market Report – November, 2022

Buying recommendations by Certified Origins

What’s happening this month?

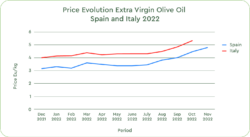

With few exceptions, the official forecasts governments and associations released across the Mediterranean area confirm a quite grim scenario for the Olive Oil sector in 2023. Fearing a potential inventory shortage, many players have been rushing to purchase the first Oils coming out of the mills early in the harvest, creating a strong demand and drastic cost increase in the market.

In Spain, the largest world producer and usually the market reference for the rest of the world, Extra Virgin Olive Oil is currently trading at an unprecedented 5 Eu/kg. This month our sourcing specialists observed transactions for conventional Italian Extra Virgin Olive Oil close to 6.00 Eu/kg and Organic at 6.30 Eu/kg. An impressive +% increase from last year in the same period.

Harvest and production in Spain

Farmers and olive oil producers continue to confirm a 50-60% drop in volumes expectations from last year, with concerns over the quality grades and pesticide levels. Given the scarcity of olives, oil mills in Spain are not working at full capacity and are limiting the hiring of seasonal workers.

Reasonable harvest expectations in Turkey and Greece

Turkey and Greece are among the few nations expecting an abundant Olive Oil crop. Turkey published an official estimate of 421,717 tons of olive oil for 2022/23, a striking +79% compared to the previous year and the highest crop in the history of this country. Should this number be confirmed, Turkey would become the second-largest olive Oil producer after Spain.

But it remains to be seen to what extent Turkey will be able to compensate for the supply shortage in other EU countries. Food commodities trades from Turkey are highly restricted after the Turkish Ministry of Agriculture and Forestry suspended direct exports of select agricultural products, including Olive Oil.

Harvest estimation for 2022/23

On November 11, the Agri-food Cooperatives of Spain (an organization that represents and defends the economic and social interests of Spanish agri-food cooperatives) published their estimates for global production:

Even if countries like Turkey and Greece will help compensate for the Olive Oil shortage, global production for campaign 2022/23 could be approximately 30% lower than the 2021/22 campaign.

Demand, Prices and our buying recommendation

If demand remains stable, Olive Oil and Extra Virgin Olive could not be available to cover the supplier during the coming year. The largest big players in the market are rushing to accumulate volumes by closing large contracts. Oil mills, cooperatives, and traders are not in a hurry to sell and are not open to setting prices for long periods, especially for high-quality, organic, and low-pesticides oil, as it is expected to be scarce.

From today’s perspective, it remains difficult to see any market stabilization for the next 6-8 months. High prices and shortages of olive oil could open the door to fraud. Strict controls and monitoring from governments and retailers will be necessary to ensure safety and good quality standards for the general public.

Given the challenging year ahead, our experts recommend that Olive Oil buyers work with their partners on long-term strategies to ensure coverage for the whole year, limit unnecessary promotions and be wary of oils on the market with price offers that are well below the market.

Feel free to reach out to talk with your team of sales experts for any additional question or comment you may have.

Sources:

Datos de cierre de campaña 2021/22, Consejo Sectorial Aceite de Oliva

International Olive Council

Olive Oil times

Back to blog