The olive oil market remains tense, despite rainfall in some Mediterranean countries.

What’s happening this month?

Most Spanish farmers and cooperatives, historically responsible for 50% of the global olive oil production, are still waiting for the long-awaited spring rain.

Other Mediterranean countries, like Italy, Greece, Portugal, and Tunisia, finally benefited from some rainfalls during these past and current months.

The concerns over the next crop, fuelled by the meteorological situation in Spain, the market leader for olive oil, are still fuelling the market without any sign of relaxation in sight.

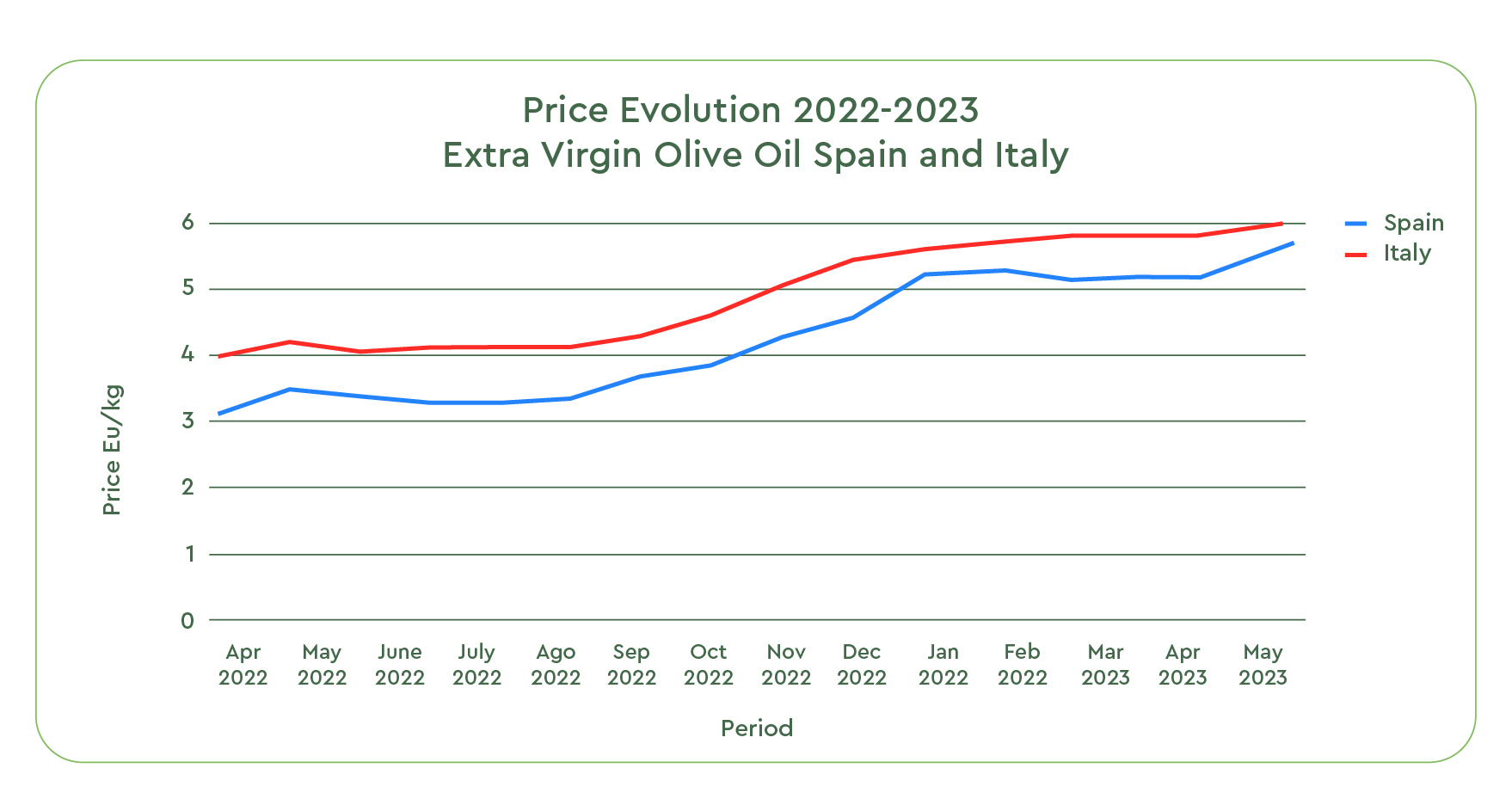

Olive Oil trading prices this month have hit record levels:

Extra Virgin Spain: 6.13 Eu/Kg (Source: Poolred)

Extra Virgin Italy: 6.36 Eu/Kg (Source: ISMEA)

Extra Virgin Greece: 5.53 Eu/Kg (Source: ISMEA)

Extra Virgin Tunis: 5.33 Eu/Kg (Source: ISMEA)

In just one month, the value of EVOO in Spain has increased by 12%, Greece by 6%, and Italy by 4%. Tunisia, on the other hand, remains stable.

Our sourcing team predicts further increases from the official reports in the coming weeks.

Transactions for quality and pesticide-free extra virgin, refined, and lampant olive oil are already trading with a +0.50 premium over the average costs reported on most official sources.

The situation in Spain

Although some parts of Spain experienced rain in May, the Andalusia region, one of Spain’s largest farming areas, didn’t report any significant precipitation.

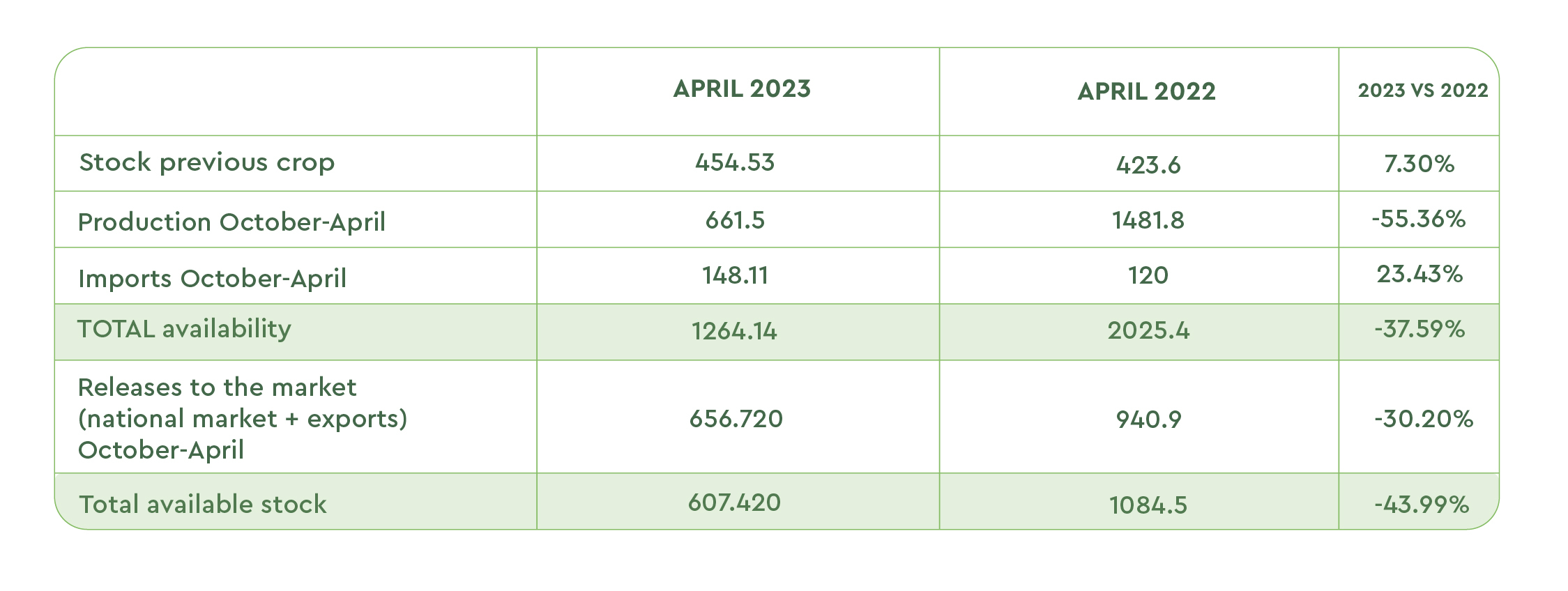

From October to April 2023, Spanish mills delivered 661,500 Tons of olive oil in total, while 656,720 Tons were released to the market (238,330 Tons allocated to the national market and 418,390 for exports).

Today, Spanish producers can count on an inventory of 607,420 Tons, a value nearly 50% lower than the levels observed in April 2022 (1084,500 Tons).

The balance of the olive oil inventory published by the monitoring entity AICA (Agency for food control) shows that in April, Spanish producers released, in total, “only” 78,000 Tons* to the local market: a 14 % drop compared to April, and 11% lower than the average transactions in the last five months.

This partial decrease is driven mainly by high costs, affecting the demand and sales at the retail level directly. Any reduction in consumption in Spain at this point could be seen as good news for international traders and olive oil players, who will be looking soon to secure inventory to cover their needs as best as possible until the new harvest.

(*We used a 15,000 Tons of imports estimate as we wait for Customs consolidated data.)

EVOO Retail Price in Spain

Historically, Spanish retailers have been adopting extremely low olive oil prices to attract new clients into their stores.

This year, while most major Spanish retailers are still commercializing extra virgin oil at an average shelf price of 6 Eu/Lt, according to Olimerca, a magazine specializing in market analysis in the olive oil sector, some stores increased the cost to 6.50 Eu/Lt, and the others will follow shortly.

In May 2022, Spanish citizens spent around 4,50 Eu/Lt on average for one liter of olive oil. Since November 2022, families have been confronted with gradual price increases of 0.15-0.20 Eu/Lt. The new projections for the second half of 2023 will translate into a 45% cost increase compared to the previous year.

Retailers will soon face a dilemma, forced to choose between absorbing the cost increases internally or accepting the risk of changes in the behavior of their customers, who will eventually start looking for alternatives.

The stock situation in Italy

The local demand for olive oil in Italy has also partially decreased (approx. 20% compared to the same period in 2022), only somewhat easing the concerns for potential future shortages.

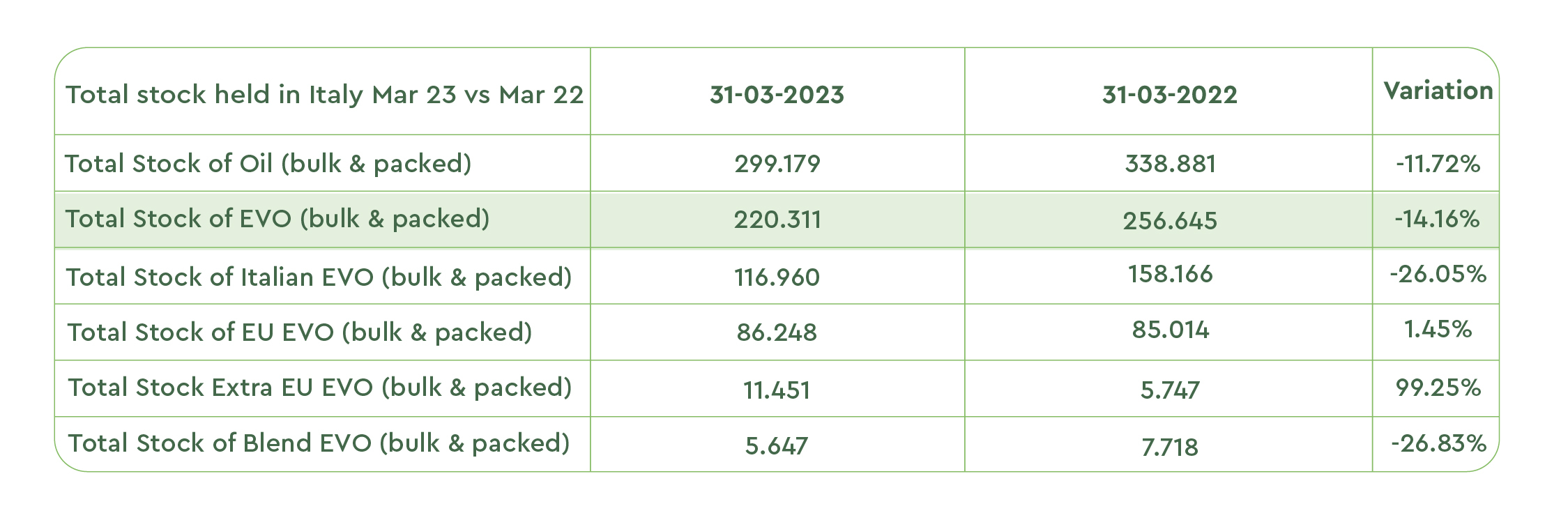

The reserves of olive oil available on storage in the country in March 2023 amounted to 299,179 Tons, of which 73.6% was represented by extra virgin (220,311 Tons). Of these 220,311 Tons, over half of the stock (53.1%) was Italian extra virgin (116,965 Tons), while 39.1% imported from other European countries (86,248 Tons) and 1.7% from Extra-Eu countries (11,451 Tons).

Compared to March 2022, the extra virgin olive oil inventory in Italy decreased by 14%, and the availability of Italian extra virgin oil specifically was 26% lower compared to the same period of the previous year.

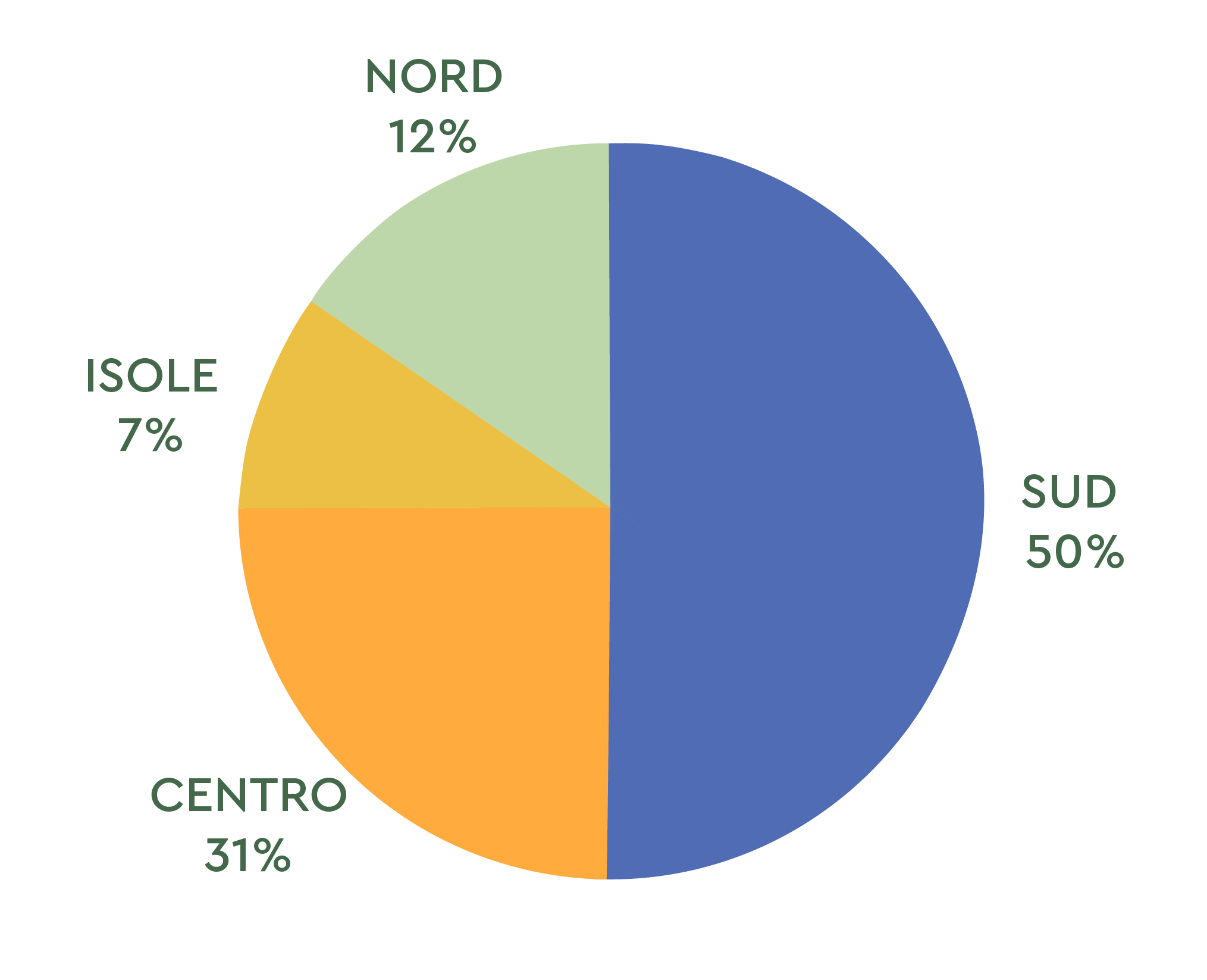

Southern Italy, alone, holds the majority of the Italian olive oil inventory (50.2%), with the significant contribution of Puglia and Calabria regions (33.5% and 8.5%, respectively).

At the regional level, the first 4 Regions (Puglia: 69, 736 Tons, Tuscany: 44, 287 Tons, Umbria: 25,262 Tons and Calabria: 9,906 Tons) have 70.1% of the entire national stock in their silos.

Early forecasts for The Mediterranean Basin

The recent rainfalls in Italy, and other Mediterranean countries provide some mildly positive outlook for the next European campaign.

Although it is early to have a valuable forecast, some experts believe that the next Italian crop could reach 400,000 Tons, and project Portugal to increase production of 20% compared to the current crop (130,000 Tons).

Mild optimism from Tunisia and Greece as well, thanks again to the recent rain episodes.

Final Thoughts

The drought in Spain will continue to keep the markets substantially high. Without water, the future of the Spanish olive oil production remains at risk, with effects across the whole supply chain.

We expect prices to remain high for the time being, with the incognita of additional demand, that could increase further the existing pressure on the olive oil supply.

On May 22nd, the PLMA in Amsterdam – Europe’s biggest show for private label – will open its doors to give buyers and sellers the opportunity to come together.

Certified Origins will be there. Come see us at our booth at Hall 8, stand 8.P28 to chat about the future of extra virgin olive oil and how we can help you navigate this complex situation.

Sources:

Gobierno de España, Ministerio de Agricultura, Pesca y Alimentación Olimerca

Olive Oil times

AICA Agencia de Información y Control Alimentarios

CNBC

Poolred

Ismea Mercati

Back to Learn & Discover Back to Market Reports