Olive Oil Monthly Market Report – March, 2023

Buying recommendations by Certified Origins

What’s happening this month?

Global Olive Oil production drops by 26%. Prices at the source remain high as weather forecasts keep affecting the market.

After the continuous upward trend of the first quarter of 2023, Olive Oil market prices are finally stabilizing, thanks to fewer transactions by the most significant players.

The scarce availability of fresh and pesticide-free Extra Virgin Olive Oil (ideal for export) created a diverse market, considerably increasing the gap between lower- and higher-quality batches.

The availability of older oil will allow producers to keep their price point under control, increasing at the same time the chances for quality issues during the year, given the faster acidity levels degradation once the oil is removed from controlled temperature storage and bottled for transportation.

Market Trade overview

EU Conventional blend/ Spanish Evoo: from 5.30 Eu/Kg to 5.50 Eu/Kg

EU Organic blend/ Spanish Evoo: from 5.95 Eu/Kg to 6.25 Eu/Kg

Italian Conventional Evoo: 6.30 Eu/Kg

Italian Organic Evoo : 6.60 Eu/Kg

Greece Conventional Evoo: 5.45 Eu/Kg

Greece Organic Evoo:5.90 Eu/Kg

Tunisia Conventional Evoo: 5.30 Eu/Kg

Tunisia Organic Evoo: 5.60 Eu/Kg

Refined Olive Oil: 4.90 Eu/Kg

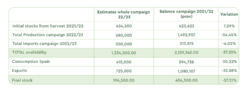

Production and Balance in Spain

The Spanish government reported in February an output of just 35,528 Tons of Olive Oil, bringing the total production for this year to 650,000 Tons, a shocking 55% decrease compared to the previous crop.

As we approach the end of the 22/23 harvest campaign, there are little doubts around the realization of the pessimistic assessments by local experts, expecting the total production to set at 680,000 Tons.

Spanish balance can count on a stock of 740,000 Tons of Oil sitting in silos, a value 44% lower than the remaining stock in the same period in 2022.

High prices will help to slow down and regulate demand. Still, assuming a historical monthly output of 95,000 Tons (Export + internal Sales), Spanish producers could face substantial challenges in satisfying internal and market demand until the end of the year.

Between October 22 and January 23, Imports from North Africa and other European countries to Spain reached 97,600 Tons, potentially slowing down in the coming months as other countries also deal with scarce crop results.

The Spanish Ministry of Agriculture, fishing, and food has published a tentative balance sheet for the Olive Oil campaign in 2022/23*:

*From 01.10.2022 to 30.09.2023

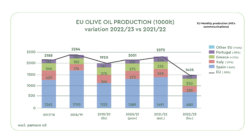

Harvest results in EU and non-EU production countries

Based on the agricultural and rural development report published by the European Commission on 23.02.2023, the EU-producing countries should reach a total production of 1,405,000 Tons.

While Spain, Italy, and Portugal are well below their average yield, Greece will help balance the losses. Europe’s crop will be 40% below the previous year (2,272,000 Tons).

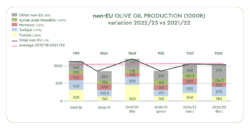

Olive Oil production results from non-European countries, on the other hand, are just 1% behind the previous year’s (1,127,000 Tons vs. 1,120,000 Tons). The losses from Tunisia (-25%) are balanced by the positive yields from other areas, such as Turkey (+17%).

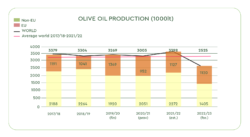

Globally the 2022/23 campaign should reach 2,525,000 Tons, a 26% drop compared to 2021/22: 3,398,000 Tons. And 23% lower than the average during 2017/18 – 2021/22 period.

Final Thoughts

Rain, temperatures, drought, and water scarcity are most Mediterranean countries’ main concerns. Italian farmers celebrated the arrival of rain in February, but it is still early for any estimates of its effects.

Producers hope for abundant rain this spring, especially in Spain and Tunisia. The water would help the trees to recover from an arid summer, set the bases for a positive harvest season, and help market prices to trend downwards, especially for refined and low-quality virgin oils.

In this context of uncertainty and scarcity, we recommend that all our partners and friends work closely with their sourcing and QA teams to avoid quality issues later in the year.

Reach out to talk with your team of experts for any question or comment you may have.

Sources:

Ministerio de Agricultura, Pesca y Alimentación

European Commision Agriculture and rural development

International Olive Council (IOC)

Back to blog