Olive Oil Monthly Market Report – February, 2023

Buying recommendations by Certified Origins

What’s happening this month?

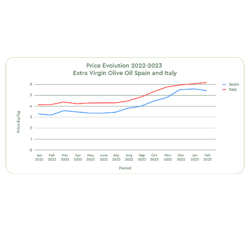

While prices for Extra Virgin Oils remain generally stable since mid-January, prices for Lampante (Lamp oil) and virgin oils rose again recently.

This increase was a surprise for many operators in the market, after a period of relative calm and even downwards trend. Today, Lampante Oil is trading at 4.70 Eu/Kg, about + 57% compared to last year in the same period.

The cause for this increase is to be found in the poor production and quality figures released by the Spanish government at the beginning of February.

According to these official reports, Spain – the largest world producer for Olive Oil and trading market leader – is approaching the end of the harvest with only 614, 331 Tons of Olive Oil, about half of Spanish average crop.

Market trade overview

Following an unfortunate season for Olive Oil farmers in the Mediterranean area, the export market is still active, especially for Blends, in high demand by large retail chains.

Here some prices of Mediterranean production countries:

• Evoo EU Blend conventional at 5.40 Eu/Kg

• Evoo EU Blend organic at 5.90 Eu/Kg

• Evoo Tunisia conventional at 5.15 Eu/Kg

• Evoo Tunisia organic at 5.50 Eu/Kg

• Evoo Italia conventional at 6.30 Eu/Kg

• Evoo Italia organic at 6.60 Eu/Kg

• Evoo Greece conventional at 5.35 Eu/Kg

• Evoo Greece organic at 5.85 Eu/Kg

(**This is only an indication, prices vary depending on the quality.)

Sources: Poolred, Ismeamercati

Turkey and Syria

Sad news came in early February from Turkey and Syria, both hit by a devastating earthquake resulting in many victims and structural damage.

Turkey made the headlines in recent months with a strong Olive Oil production expectation of approximate 300,000 Tons, setting the country to become the second olive oil producer in the world in 2023. Several external sources confirm that due to the damages to the logistic infrastructure, only 50% of the products dedicated to export, including Olive Oil, can leave the country.

Spain

In early February, the specialized magazine Olimerca described Spain’s production drop as a “drama of incalculable dimensions and consequence”. For the magazine, only a drop of internal and export demand of approximate 45% could balance the lack of Spanish supply in 2023.

The 614,331 Tons of olive oil produced after 4 months of harvest in 2023 represents a drop of 54% compared to the same period of last year and far from the initial estimations of 700,000 Tons made at the beginning of the campaign 2022/23.

While export figures fall, import numbers are growing drastically. Since October Spain has imported 107,000 Tons of olive oil, 39 % more than last year on the same period.

Countries like Greece and Portugal are benefitting from Spain’s crop losses.

Organic Extra Virgin Oil production has been disproportionally affected. Farmers and cooperatives struggle with problems provoked by the lack of water and the fact that organic fields cannot be treated chemically against pests and diseases.

In a context of scarcity of Olive Oil, Spanish producers are prioritizing the packaging business over the bulk trade.

The future of Spanish intensive and super intensive Olive farming is still uncertain and strongly linked to the weather and climate. December rains were not sufficient to fully restore Spain’s largest water reservoir in Andalucia (Iznajar), down to 18%.

Final Thoughts

This week our sourcing and quality team attended the Biofach show in Germany, meeting with other experts from the Olive Oil sector. The general concern for producers and mill cooperatives remains to be the continuous lack of water. Retailers and traders struggle to deal with the price increases and a possible drop in demand.

All parts look at Spain next crop and hope for enough rain during April and May to compensate the damages caused by the prolonged drought and heat waves.

Spring is approaching and we will soon be able to observe the flower pollination on the olive trees as first projection of the presence or lack of olive fruits for the next harvest later in the year.

In the meantime, we recommend our business partners and clients to move carefully yet proactively in the trade market, to ask for traceability and quality documents, and to be cautious with offers below the market price.

Sources:

Olimerca

Olive Oil times

Spanish Ministry of Agriculture, Fisheries and Food

Envalses net