Olive Oil Monthly Market Report – April, 2023

Rising demand, scarce stock reserves, and no rain in sight: the Olive Oil market remains high.

What’s happening this month?

Rising demand, scarce stock reserves, and no rain in sight: the Olive Oil market remains high.

The much-awaited rain has not yet arrived in most Mediterranean regions, and water scarcity is a problem for many Olive Oil farmers and producers.

Despite the historically high prices, the demand for high-quality Extra Virgin Olive Oil (EVOO) remains sustained, driven by the retail export market’s needs. The number of transactions for other grades, like Virgen and Lampante Oil, is also growing after a period of relative calm.

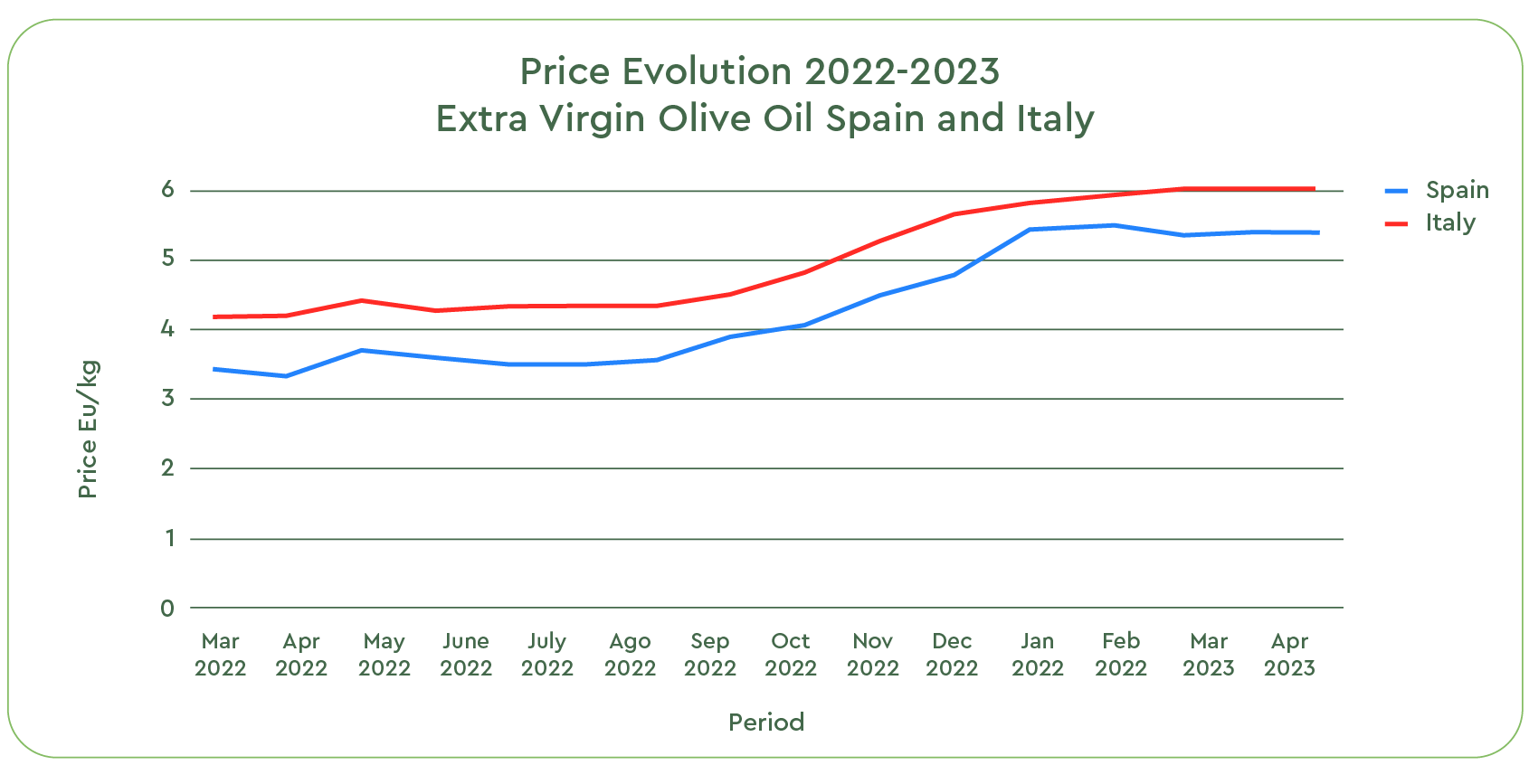

Poolred, a well-known organization engaged in the “Promotion and Development of the Olive Grove and Olive Oil in Spain” reports an average trading price of 5.28 Eu/Kg for Spanish Extra Virgin Olive Oil this month. A value in line with the trends observed since January 2023, and approximately 3% higher than the average price of 5.13 Eu/Kg since the beginning of the harvest in October 2022.

In 2022, the same origin and quality was trading closer to 3 Eu/Kg.

Sources: Poolred, Ismea Mercati

Production balance in Spain

Imports to Spain are slowing down. Only 12,000 tons of olive oil were imported into Spain in March, well below the monthly average of 22,000 tons observed in the previous months.

On the other hand, as far as exports and local consumption are concerned, Spain is not reporting any falling figures yet, despite persistently high prices: by end of March, 31,330 tons were absorbed by the local market, while 58,190 tons were shipped abroad. Both figures roughly correspond to the monthly average for this campaign, even slightly higher than the figures from February (26,430 tons for internal consumption + 54.500 tons for export).

There is a general consensus among experts and wholesalers that if the demand from export markets remains stable, Spanish producers will face the risk of falling short in olive oil reserves before the transition to the new crop, in October 2023.

Global comsumption of Olive Oil

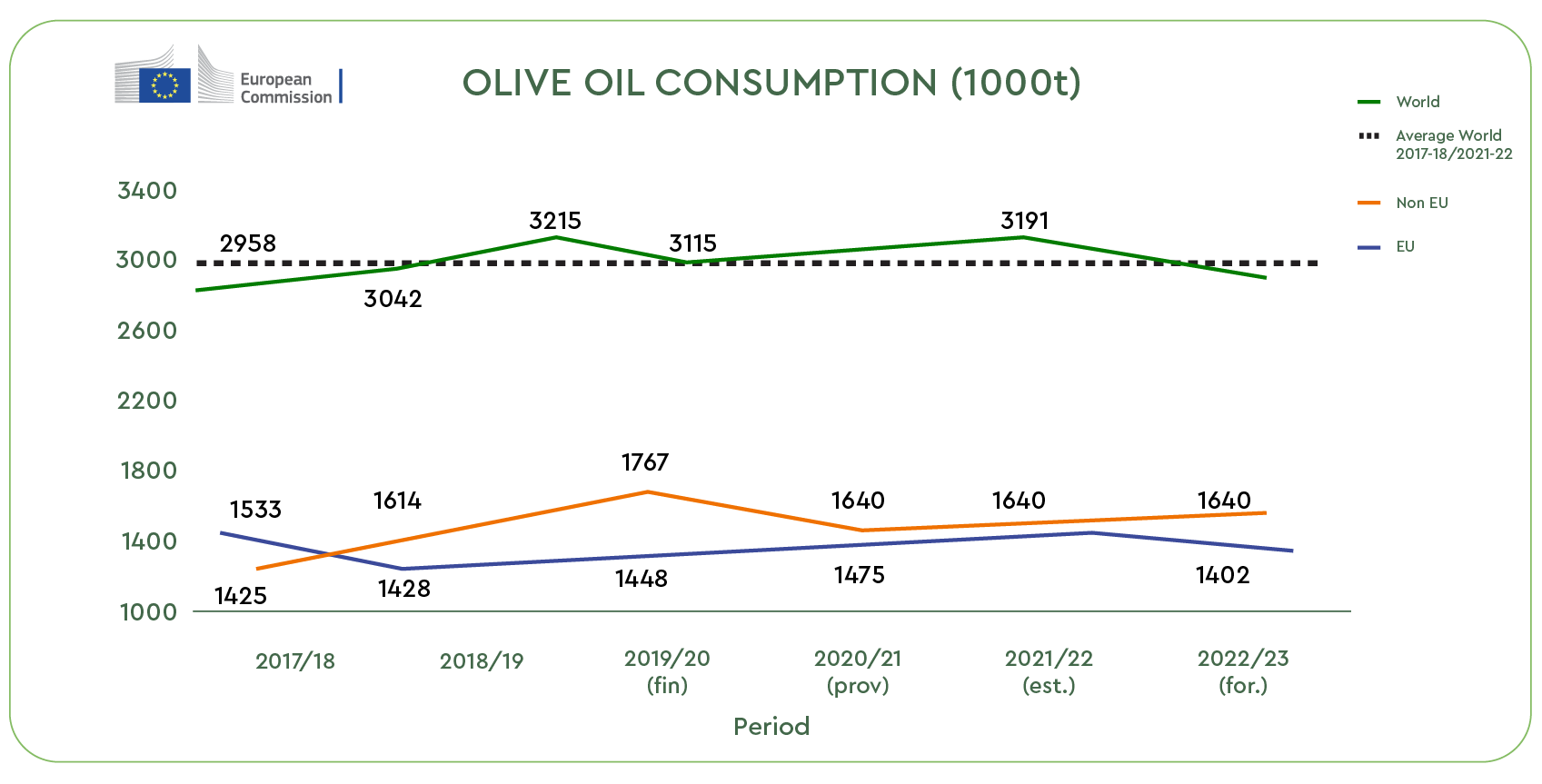

World figures on consumption on the effects of the high-retail price for all olive oil grades are at times discordant. A recent estimate by the International olive oil Council suggests only a 5% drop for global consumption for olive oil and extra virgin olive oil, when compared to the last 5 years. In Spain, the main producer and consumer of olive oil per capita in the world, has instead observed a sharp drop per household, closer to 30%.

Source: European Commission

According to International Olive Council, global imports are up by 11.8% compared to the same period last year, reaching a total amount of 274,751 tons traded from October to January 2023. The main importers are: the United States with 35%, the European Union with 17%, Brazil with 8%, Japan with 6%, Canada with 5%, China with 4%, and Australia with 3%.

Production in Greece and Portugal

Greece is one of the few countries with positive campaign results this year. According to an estimation published by the EU Commission, Greece will reach in total approx. 350,000 tons, an increase of 51% compared to last year.

Historically Italian traders have been among the largest importers of Greek EVOO. This year, according to the European platform monitoring olive oil exchanges, between October and December 2023, Spain imported approximately 65% more from Greece than last year. This unprecedented demand is expected to drain Greek reserves faster than usual and sustain the market appreciation for this origin.

Portugal is another crucial global player in olive oil, contributing 126,000 tons to the market. A decrease of -39%, compared to crop from last year (206,000 tons), but still 26% higher than the initial expectation.

Estimates for the next 2023/24 campaign, starting in October 2023, are still unclear for both countries. If Greek farmers begin to raise some concerns about the lack of rain they are experiencing in the first half of the current year, Portuguese experts look at the future with great optimism.

Final Thoughts

Experts, producers, cooperatives, and traders agree that if the lack of rain, high temperatures, and low water reserves experienced in 2022 subsists this year, the availability of large volumes of olive oil and the quality will suffer.

Spain and Italy remain the largest players in the olive oil market. Without better weather conditions and higher water reserves available to the farmers in the Mediterranean area, we expect an extended period of substantially high market valuations for most of the origins and olive oil grades.

Reach out to talk with our team of experts for any question or comment you may have.

Sources:

Gobierno de España, Ministerio de Agricultura, Pesca y Alimentacion

Olive Oil times

International Olive Council

European Commission: Agriculture and rural development

Poolred

Ismea Mercati