Olive Oil Market: Calm Before the Storm?

5 MIN READ

By Franziska Finck — April 29, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s happening this month?

This month’s key development was the announcement by the White House of two sets of additional import duties imposed by the U.S. government on a wide range of imported products, including olive oil.

Following the initial announcement on April 9, 2025, some of these charges were suspended for 90 days.

This left foreign exporters and U.S. businesses facing an almost universal import tax of 10% on goods entering the United States, with exceptions for certain products from Canada and Mexico, and higher duties still applying to imports from China.

At the time this report was prepared, the following rules apply:

- European Union (EU): Initially set at 20%; currently suspended, subject to the 10% universal tariff.

- Tunisia: Initially set at 28%; currently suspended, subject to the 10% universal tariff.

- Morocco: Subject to the 10% universal tariff; no additional country-specific tariff imposed.

- Turkey: Subject to the 10% universal tariff; no additional country-specific tariff imposed. Argentina: Subject to the 10% universal tariff; no additional country-specific tariff imposed.

- Chile: Subject to the 10% universal tariff; no additional country-specific tariff imposed.

These measures remain in place until the suspension ends, with future tariff adjustments subject to ongoing trade negotiations. The decision temporarily reduced tensions in the olive oil market, with prices remaining stable throughout April despite continued volatility.

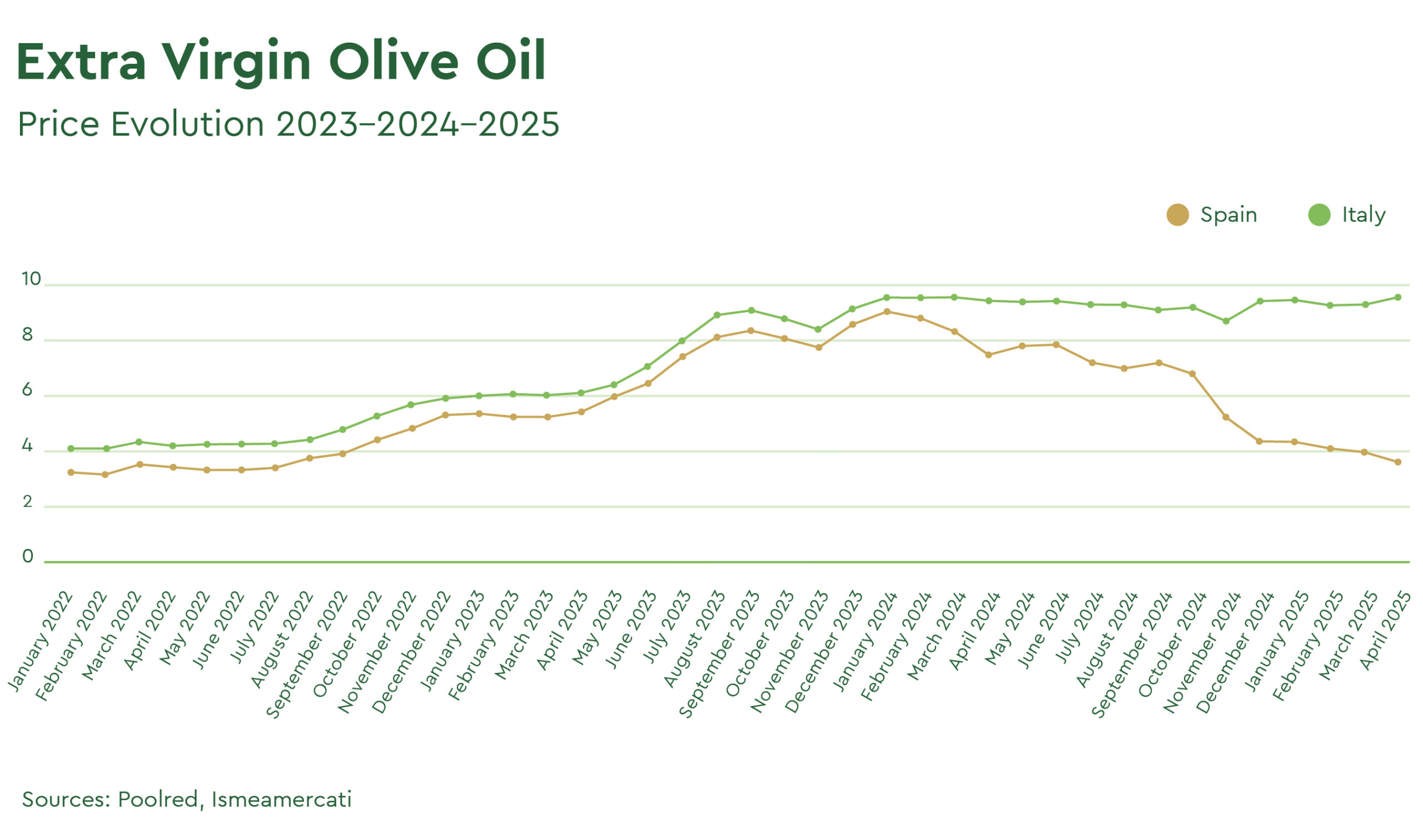

Price data from Poolred (Spain) and ISMEA (Italy, Greece, Tunisia) indicate only minor fluctuations compared to the previous month:

Note: These average values reported by trade platforms do not reflect quality differences or individual batch prices.

In mid-April, the Spanish Ministry (AICA) published its monthly report, confirming high production figures, stable stock levels, and an optimistic forecast for the upcoming harvest. This favorable stock situation has contributed to a continued downward trend in Spanish olive oil prices, which some producers now describe as unsustainably low.

In contrast, Italy is experiencing a different market scenario where low stock levels keep Italian olive oil evaluation sustained, leading to a price gap of nearly 4 Eu/kg between Spanish and Italian products at the origin.

A Global View on the Olive Oil Sector: New Challenges and Opportunities

As highlighted in previous reports, the olive oil sector remains a cornerstone of Mediterranean agriculture and food industry. It continues to play a critical role in global trade, from emerging producers to established players, as well as retail markets seeking healthier alternatives to refined oils.

The recent 90-day suspension of U.S. tariffs on olive oil imports offers only temporary relief and does little to change the underlying reality: international markets are likely to face a prolonged period of complexity and uncertainty.

It remains unclear how the introduction of higher U.S. duties — expected to drive up retail prices in what is today the world’s second-largest retail market — will ultimately shape demand and influence global trade flows.

A sustained decline in U.S. imports would be particularly challenging for its traditional suppliers, especially in a year when many producing countries already report high stock levels. In such a scenario, exporters may be forced to accelerate the search for new markets and recalibrate their investment strategies.

Against this backdrop, Brazil has emerged as a potential bright spot. According to a recent Olive Times report, the Brazilian government is moving toward the elimination of import tariffs on European olive oil. While Brazil’s current annual imports of roughly 100,000 Tons remain modest compared to U.S. volumes, the removal of these trade barriers could provide much-needed diversification for European producers facing headwinds elsewhere.

Tunisia, by contrast, faces a significantly more challenging outlook. Under current U.S. plans, Tunisian olive oil would be subject to a 28% import duty once the suspension period expires — a steep increase that could severely undermine the country’s competitiveness. The U.S. remains a key market for Tunisian oil, particularly for blends that are widely favored by large American retailers, where price sensitivity plays a critical role. Tunisian officials are using the 90-day suspension window to seek a revised agreement with Washington, though the outcome of these negotiations remains uncertain.

Such a steep increase would sharply erode Tunisia’s position relative to other key producers, including Turkey, where duties are set at 10%, and Spain at 20%.

Any significant drop in U.S. demand would come at a difficult moment for Tunisia, as the country anticipates a surge in production. The potential fallout could extend well beyond its borders, disrupting supply chains and affecting businesses that rely on Tunisian oil as a key ingredient and blending component.

In this evolving landscape, producers, traders, and buyers are watching closely, aware that the outcome of the next round of tariff negotiations could reshape the global olive oil market in the months ahead.

Spain’s Balance Sheet

In March, Spain reported olive oil production of 1,406,913 Tons, with the harvest now largely complete. This marks a 64% increase compared to the previous year and stands 28% above the four-year average — a notable rebound for the world’s largest producer after difficult years.

Domestic consumption and exports (excluding imports) totaled 119,019 Tons, well above the monthly average of the last two crops. The recent drop in prices appears to have stimulated buying activity, helping to absorb part of the market surplus.

Against this backdrop of strong production, most stocks remain in producers’ hands, currently estimated at around 774,000 Tons. Bottling companies, by contrast, are proceeding cautiously, maintaining inventories between 175,000 and 200,000 Tons while closely monitoring price movements.

The outlook for the next harvest is broadly positive. Recent rainfall has replenished water reserves, and olive trees, alongside the soil, show signs of recovery after several years of drought. Early estimates suggest production could reach 1.8 million Tons, should these favorable conditions continue.

Yet even as volumes rise, concerns about quality persist. Supplies of premium-grade extra virgin olive oil (EVOO) are becoming increasingly scarce, with high-quality batches often available only at a significant premium, a factor that may shape both pricing and trade flows in the months ahead.

Italy’s Balance Sheet

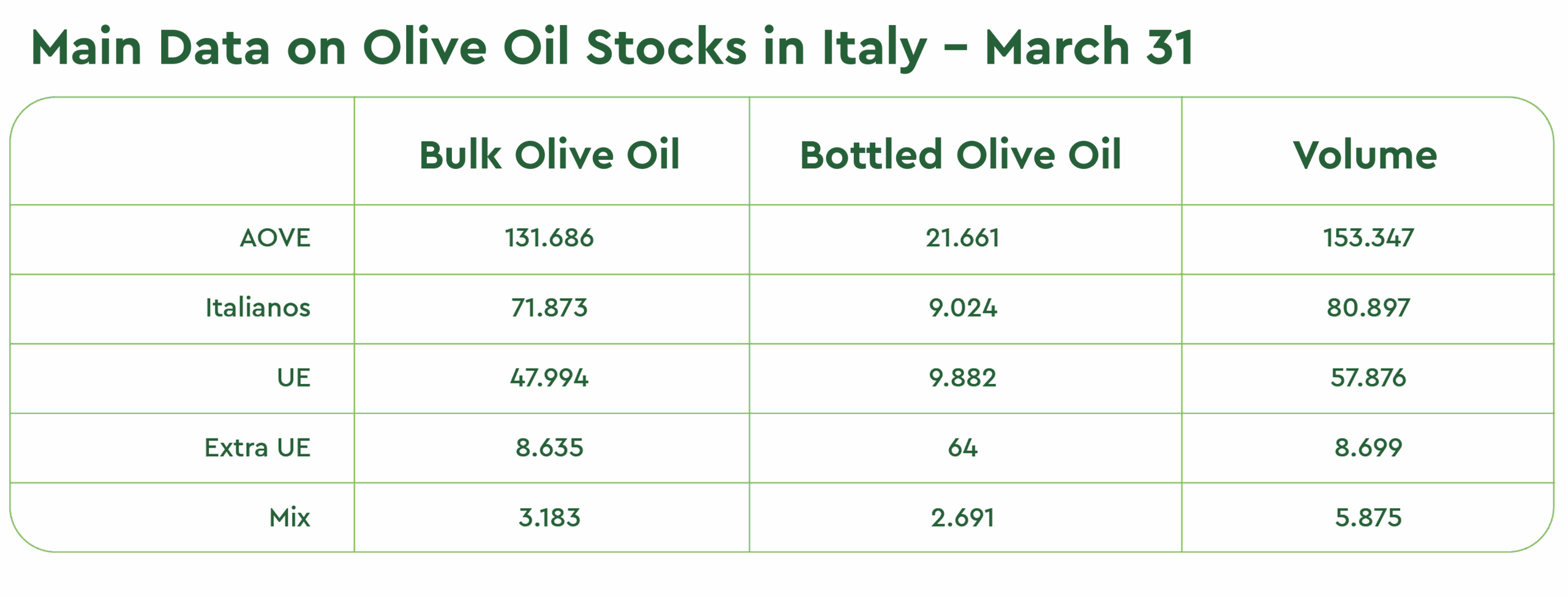

While Spain expects to carry over a substantial 450,000 Tons of olive oil into the next season — enough to ensure a smooth transition between harvest cycles — the situation in Italy remains considerably tighter. As of March 31, Italy’s olive oil stocks stood at 212,863 Tons, down 12.3% from the previous year.

153,347 Tons are classified as extra virgin olive oil, with just over half (80,897 Tons) confirmed as Italian origin. The weak domestic harvest has forced Italy to ramp up intra-EU purchases by 53%, bringing in 57,876 Tons from neighboring producers to help meet demand. Breaking down the extra virgin category further, 131,686 Tons remain held in bulk, while 21,661 Tons are already bottled and ready for market.

This continued decline in stock levels underscores the tight supply conditions in Italy, a key factor behind the country’s persistently high price levels. With inventories stretched and replenishment options limited, the prospect of any meaningful price relief in the near term remains uncertain.

FINAL THOUGHTS

On one hand, Spain continues to deliver positive signals: high production volumes, favorable weather conditions, and an encouraging outlook for the upcoming flowering season all contribute to sustained downward pressure on evaluations at origin.

However, these lower prices are already fueling concern among Spanish farmers, many of whom report mounting financial pressure. The growing frustration within the producer community increases the likelihood of calls for government intervention or support measures should prices remain at these levels. How this situation unfolds will be a key factor to watch in the months ahead.

The widening price gap between Italian olive oil and other origins could also drive shifts in global trade flows, with larger volume buyers turning to lower-cost supply where quality and specifications allow.

For now, the full impact of U.S. tariffs on olive oil trade and consumption remains challenging to predict. In the short term, the prospect of higher retail prices could trigger a temporary spike in U.S. demand, as importers move to secure volumes before suspended tariffs are reinstated.

Looking further ahead, the ongoing 10% import duty may favor other oils and fats locally produced, against olive oil, despite an increased interest in its health benefits.

What is clear, however, is that the olive oil market is operating against a backdrop of structural tension. Both buyers and sellers recognize that the sector may be approaching a period of significant change, shaped not only by evolving tariff regimes but also by shifting consumer preferences, changing trade dynamics, and the tightening availability of premium-grade extra virgin olive oil.

For further insights or tailored support, please feel free to contact our international team.

For further insights or tailored support, please feel free to contact our international team.

Back to Learn & Discover Back to Market Reports