Managing Policy, Scarcity, and Expectations Ahead of the 2025/26 Harvest

5 MIN READ

By Franziska Finck — September 24, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to

support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s Happening This Month?

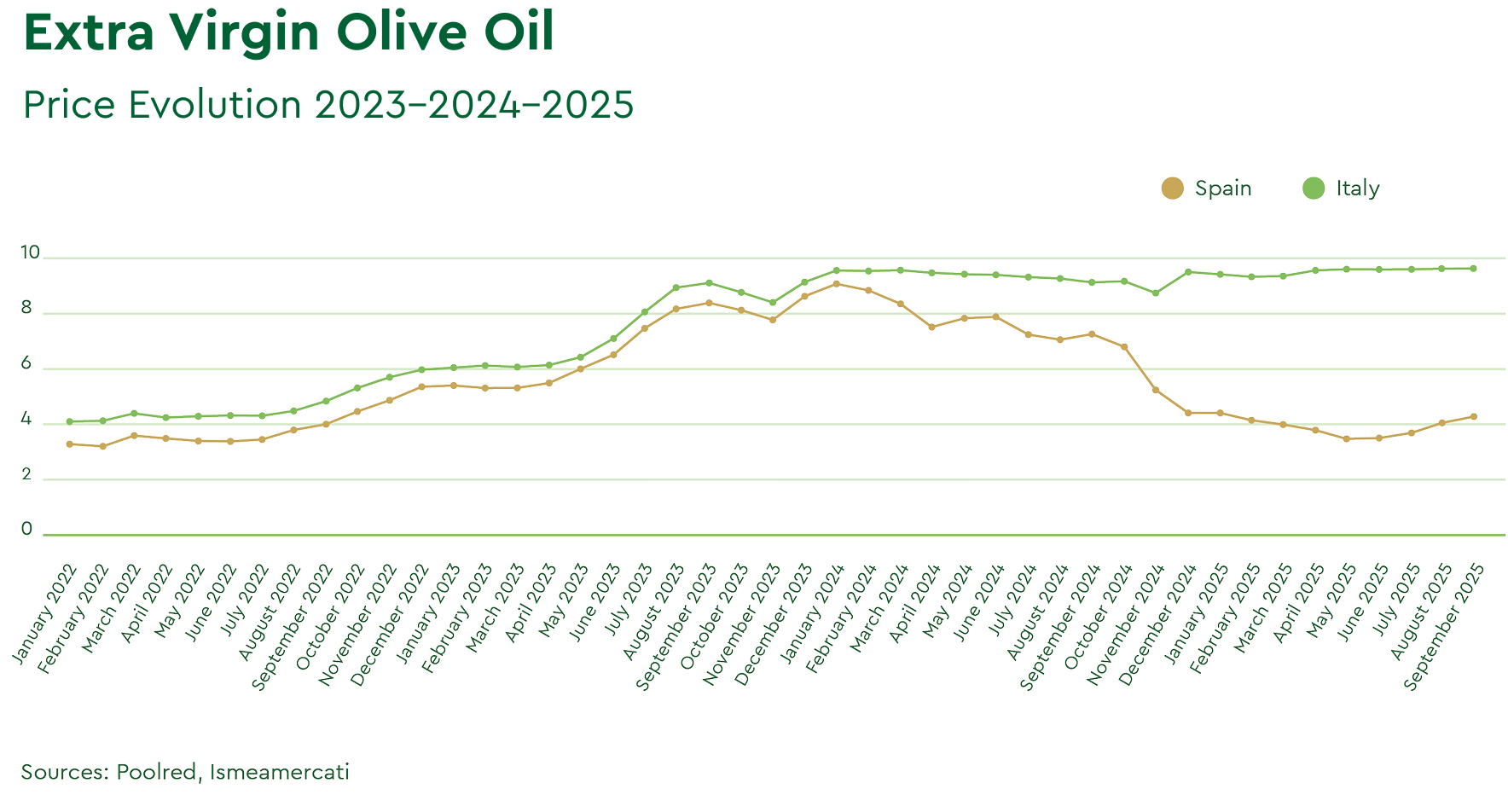

The olive oil sector is entering a decisive stage as the early harvest begins. In Spain, operators face significant pressure in sourcing high-quality oils. Remaining stocks from the 2024/25 season are scarce and of low quality, while sales volumes in August and early September reached record levels.

At the same time, preliminary crop estimates in the Iberian country for 2025/26 are being revised downwards due to persistent drought and extreme heat during the summer. These combined factors have pushed Spanish prices up by approximately 15% over the past two months.

Similar dynamics are evident across other Mediterranean origins. In Greece, robust domestic and international demand continues to sustain high price levels. Tunisia shows a different picture: although the upcoming crop is expected to be strong, market participants are holding back purchases in anticipation of lower prices. Yet, securing high-quality extra virgin olive oils in Tunisia is already becoming increasingly complex.

In Italy, demand and prices remain sustained, with little volatility observed in recent weeks. Market expectations point to a stable price environment until the harvest gains momentum.

** please note: while these official figures reflect an average across various quality grades, actual transaction prices, particularly for high-quality extra virgin olive oil, are notably higher.

Robust Pre-Tariff U.S. Olive Oil Imports and Global Trade Flows in 2024/25

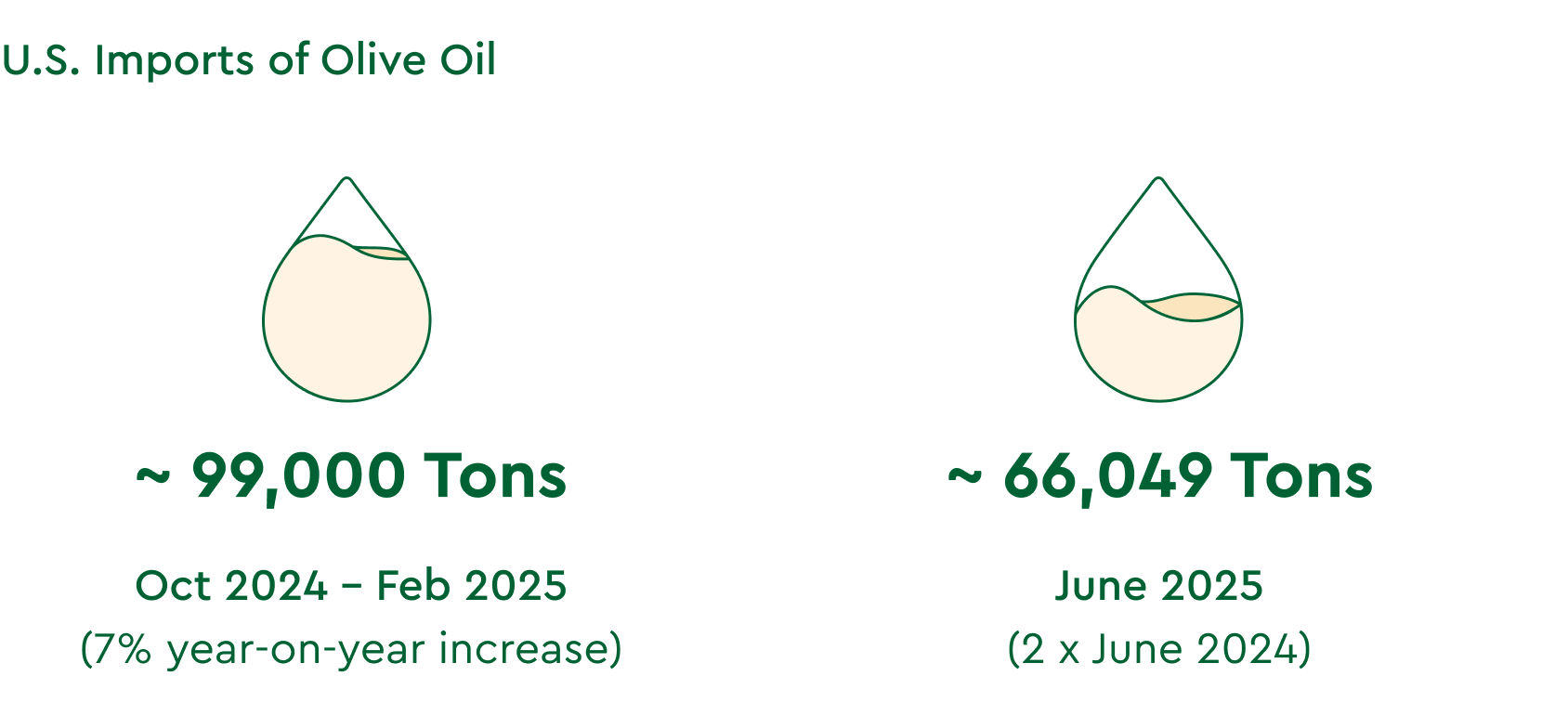

According to the International Olive Council (IOC), U.S. imports of olive oil rose sharply in the early months of the 2024/25 crop year, reaching about 99,000 tons between October 2024 and February 2025 – a year-on-year increase of roughly 7%. Imports peaked in June 2025 at 66,049 tons, double the level of June 2024.

On April 2, 2025, the U.S. government announced a new trade policy imposing a 10% tariff on all olive oil imports effective April 5. This was followed on April 9 by differentiated tariffs ranging from 11% to 50% for selected countries. As of August 2025, EU olive oil imports into the U.S. are subject to a 15% import tax under a separate agreement.

These different announcements and policy measures might have encouraged U.S.-based retailers and food businesses to accelerate purchases ahead of the tariff deadlines, stockpiling inventory.

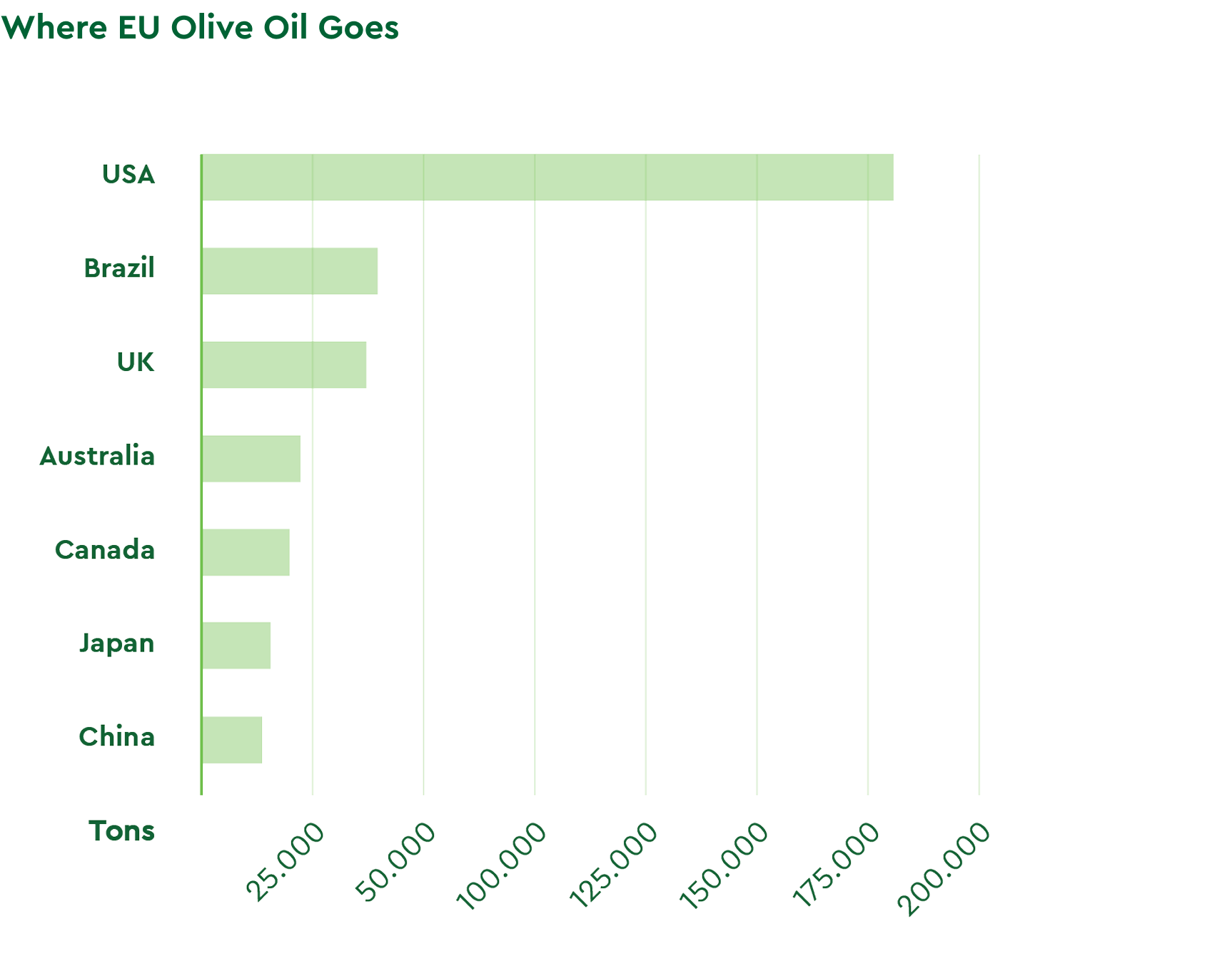

A Mercacei article published this month reported that EU olive oil exports increased by 18.9% in the first eight months of the season. Exports to non-EU markets reached 484,553 tons, compared with the same period of the previous year.

According to European Commission figures, the United States remains the largest destination for EU olive oil, with shipments reaching 181,269 tons (+14.1%). Brazil ranked second with 42,018 tons (–11.9%), while the United Kingdom stood at 41,615 tons (+1.8%). Other markets showed strong growth, including including Australia at 23,636 tons (+60.6%) and Canada, 22,943 tons (+53.3%). Conversely, exports to Japan declined to 19,532 tons (–12.3%), while China saw the sharpest increase at 17,074 tons (+86.2%).

Overall, the figures point to sustained and diversified global demand for extra virgin and other olive oils, with growth visible beyond the EU and long-established markets. Despite rising production costs and trade restrictions, Mediterranean producers continue to affirm their position in global markets.

In the U.S., where household penetration stands at roughly 40% and domestic production is unlikely to meet local demand in the foreseeable future, continued growth in health-driven food consumption is expected to widen the supply-demand gap further.

Weather and Rising Temperatures Increase Pressure on Farmers in Central and Northern Italy

According to an Olive Oil Times report from August, heavy July rainfall, humidity, and temperatures in central and northern Italy are heightening concerns over olive fruit fly infestations. These conditions are highly favorable for pest proliferation. Farmers have stepped up preventive measures while regional authorities continue to issue guidance.

In contrast, southern Italy experienced a severe heatwave and persistent drought, with record summer temperatures. Given that southern regions account for the bulk of national output, these extremes will be decisive for 2025/26 production levels. Harvesting will begin in early September in some areas, intensifying in October and November.

The previous 2024/25 season was extremely challenging, with final production around 250,000 tons, driving record-high prices. Forecasts for 2025/26 indicate possible recovery above 300,000 tons, though outcomes remain weather-dependent.

Spain’s Inventory Balance: August 2025

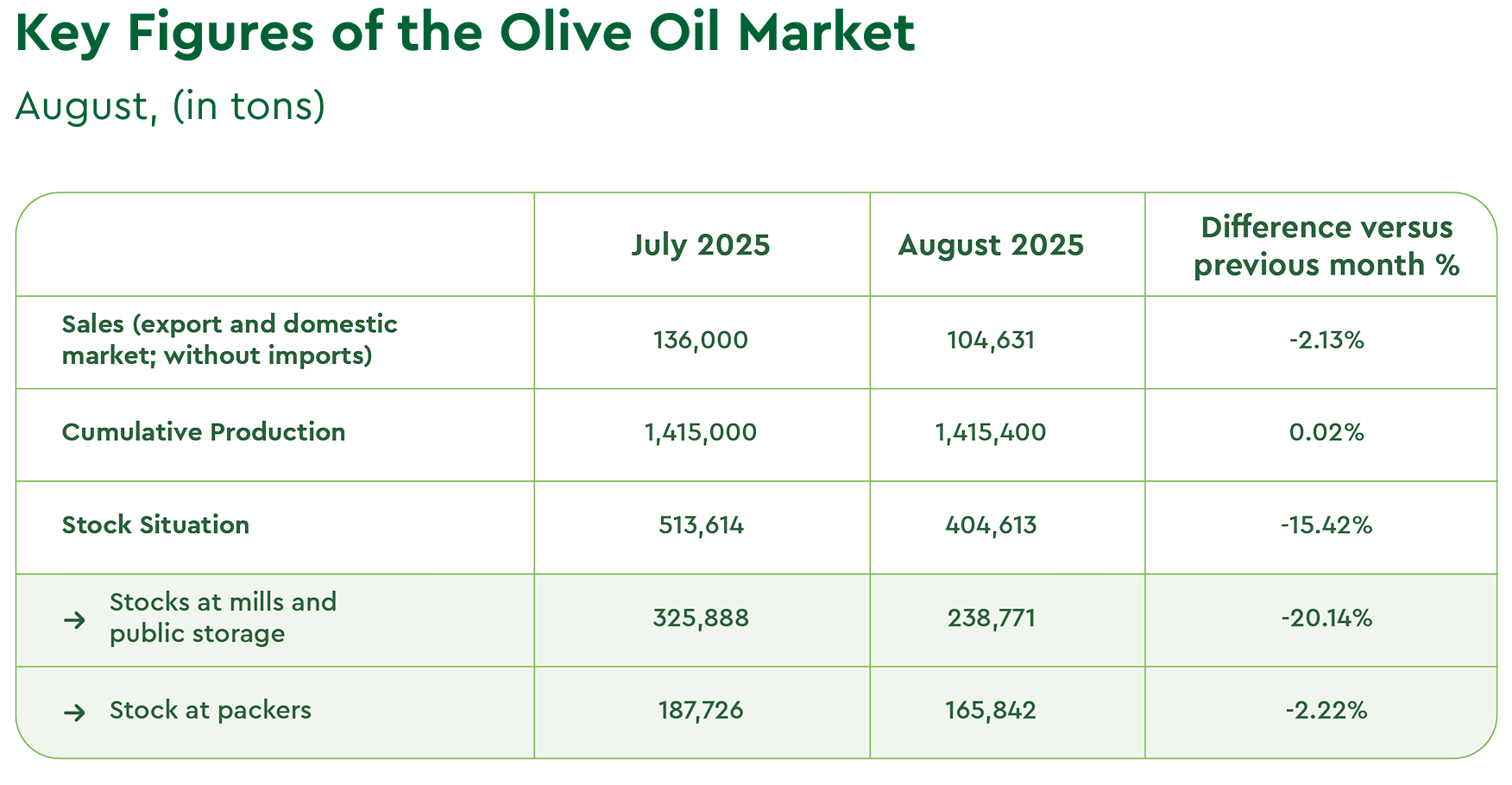

The Agency for Food Information and Control (AICA) released provisional olive oil market figures for August, the eleventh month of the 2024/25 campaign. Cumulative production stood at 1,415,380 tons.

Sales for August were approximately 120,000 tons, including imports of about 15,000 tons. This is slightly below July’s 148,000 tons, which marked the highest monthly sales of the season. Compared with the four-year average for August, sales were 20% higher, partly driven by U.S. tariff effects.

Total inventories stand at 404,613 tons, of which 235,427 tons are held in mills, 165,842 tons in packers, and 3,344 tons in public storage.

Analysts estimate that the carry-over stock into the next campaign will be slightly below 300,000 tons, still depending on September’s final sales. Overall, it is expected that total sales for the 2024/25 campaign will exceed 1.5 million tons, leaving a tight carry-over of around 270,000 tons for the transition into the following season.

Final Thoughts

Official harvest forecasts in Spain will not be released until the end of September, and experts agree that rainfall in September and October will be decisive in determining the final volumes in the region responsible for almost half of the global olive oil production.

Early projections suggest that Greece, Portugal, and Italy are all set to increase output in 2025/26. Particular attention will be on Tunisia, where a record harvest is anticipated. Combined with high U.S. tariffs and the resulting decline in exports, this could lead to a significant accumulation of stocks.

Should these forecasts materialise, increased supply would relieve market pressure and push prices lower, while tight transition volumes and weather uncertainty continue to pose risks.

Sufficient rainfall could lift production above last year’s levels in Spain, while continued drought would likely keep expectations in line with the previous campaign. Similar uncertainty applies across other key producing countries. Market conditions are likely to remain broadly stable until official figures and fresh volumes from the new crop come through.

Macroeconomic pressures must also be considered. Slowing growth, exchange rate volatility, trade policy shifts, and persistent inflation tend to reduce household spending, including cooking oils and fats. Monitoring retail sales data in the coming months will be essential to assess whether cost-conscious buyers are scaling back or maintaining demand despite elevated prices.

Alongside these headwinds, structural drivers offer reasons for optimism across the olive oil sector. Health-focused movements in the United States, together with policies in Mexico, the European Union, and the United Kingdom to curb ultra-processed foods and combat childhood obesity, are strengthening consumer preference for natural, minimally processed products.

Taken together, these factors could lay the path for deeper cooperation, new trade agreements, and targeted investment to expand global access to health-oriented ingredients. The shift resonates with the cultural and health value proposition of the Mediterranean diet and extra virgin olive oil, with its established reputation and nutritional value, is well placed to play a central role in this transition.

For tailored market insights or to explore strategic opportunities in private-label olive oil, please contact our international sales and product development team.

International Olive Council

Olive Oil Times,

Mercacei,

Poolred,

Ismea Mercati,

Junta de Andalucia.