Crop Year 2024/25 Ends with Record Spanish Exports and Weather Concerns for the New Season

8 MIN READ

By Franziska Finck — October 23, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to

support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s Happening This Month?

September marks the end of the 2024/25 crop year, making way for the 2025/26 output data. Spain maintains robust monthly export figures once again, showing that demand for Spanish olive oil remains consistently strong. The total sales have surpassed national production, confirming Spain’s prominent role in international trade.

With much to celebrate from the past season, the outlook for the Iberian olive oil sector in 2025/26 is yet to be determined. The continued lack of autumn rainfall across the Mediterranean is crucial for the full and healthy development of olives and calls into question whether forecasts from the Junta de Andalucía and Spain’s Ministry of Agriculture (MAPA) fully reflect current conditions, and might have been too optimistic.

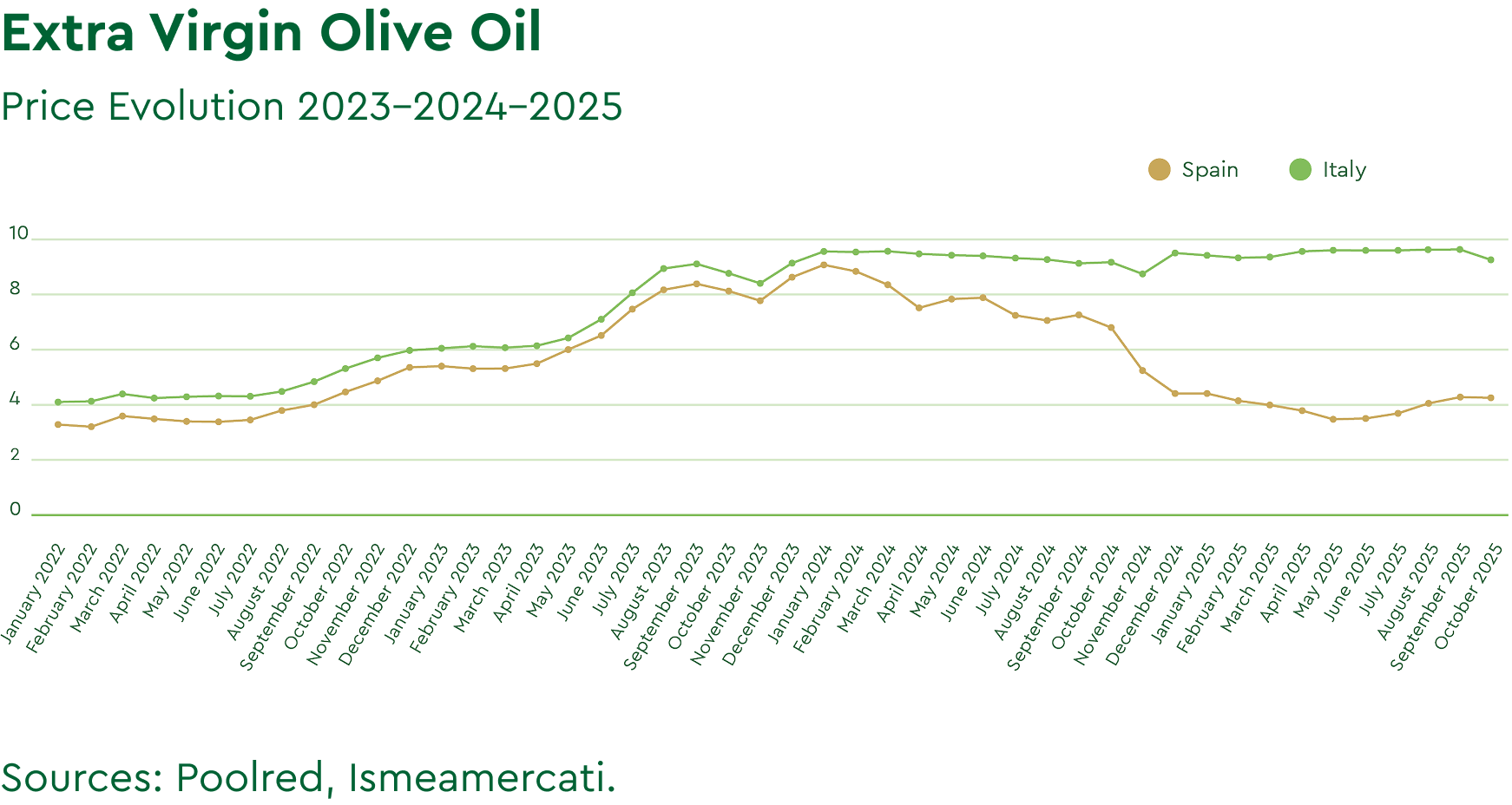

Despite these concerns, prices in Spain have remained broadly stable. Supply continues to be firm, while both domestic and international buyers are purchasing cautiously, focusing on immediate requirements rather than committing to longer-term volume coverage beyond 2026.

The global market is entering a transitional phase, awaiting the first new-season production and the long-anticipated rainfall critical for crop quality and price trends as a direct consequence.

Against this backdrop, Italian extra virgin olive oil prices have started to decline modestly from their premium levels, relative to other origins.

** Note: Reported prices are averages across multiple quality grades; premium, clean, pesticide-free extra virgin olive oil typically trades at higher values.

Spanish Balance Sheet: Summary of Crop Year 2024/25

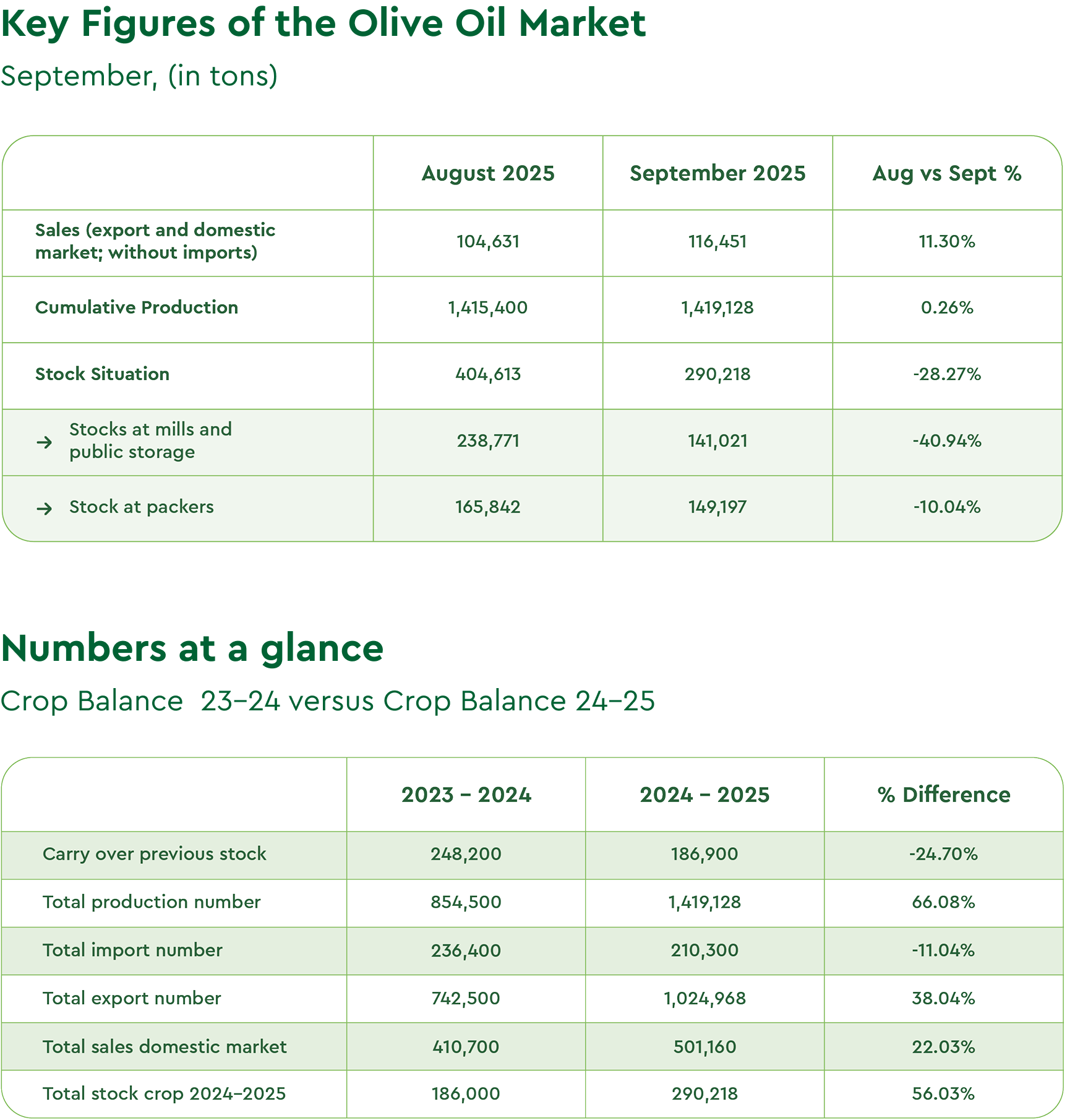

Spanish olive oil production reached 1,419,128 tons in 2024/25, a 66% increase compared with the previous year. In September, around 130,829 tons were sold, lifting total campaign sales to 1,526,100 tons (+32% vs. 2023/24).

Exports accounted for 87,868 tons in September, bringing the campaign total to 1,025,000 tons (+38%). Domestic sales reached 42,960 tons, totaling 501,000 tons for the year (+22%).

Total stocks as of 30 September 2025 stood at 290,220 tons, 70,000 tons below the long-term average and 56% above closing stocks from 2023/24.

Overall, the data indicate a strong expansion in both production and market absorption, with exports driving the largest share of growth. This suggests that the Spanish olive oil sector is not only producing more but also successfully capturing international demand.

Mediterranean Olive Oil Harvest 2025/26: Quantity vs. Quality

Experts from various sectors have shared their forecasts for the upcoming olive oil campaign in an insightful article published by Mercacei, a Spanish trade magazine specializing in olive oil.

Their outlooks can be summarized as follows:

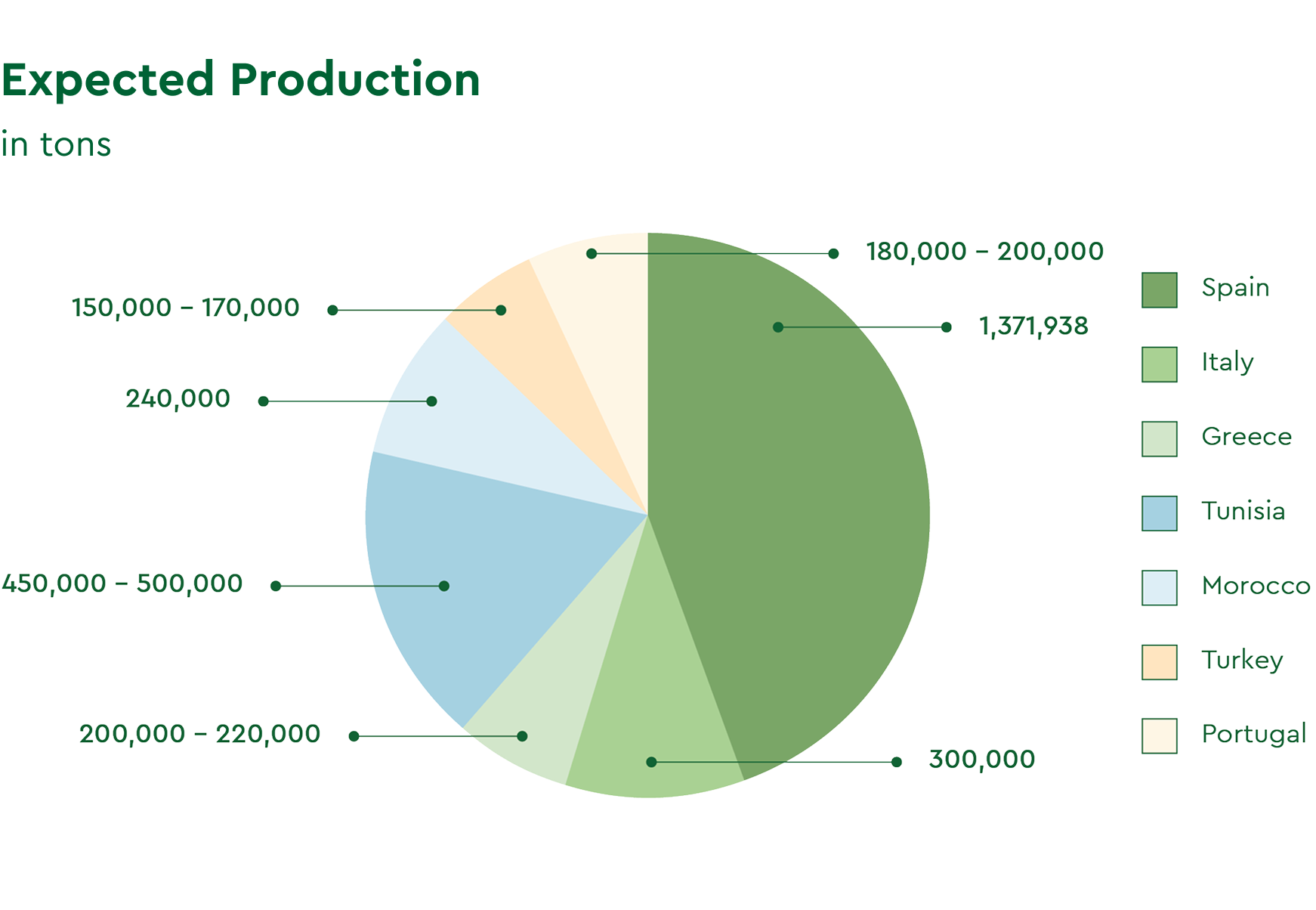

Forecasts for the 2025/26 season point to generally stable output across the Mediterranean, though regional disparities remain pronounced.

In Spain, production is expected to reach 1,371,938 tons, about 3% below last season but 19% above the six-year average. Andalusia’s output is projected at around 1,080,900 tons, 5.5% lower year-on-year yet nearly 20% above the five-year mean.

In Italy, total production is forecast at 300,000 tons, marking a 30% annual increase. Southern regions such as Apulia and Calabria are expected to rise by 30–40%, supported by timely summer rainfall that offset spring drought effects.

In Greece, production is projected between 200,000 and 220,000 tons, slightly lower than the previous campaign. The Peloponnese should contribute around 90,000 tons, Crete 50,000 tons, and other regions smaller volumes, depending on yield results.

In Tunisia, favorable rainfall has improved conditions nationwide. Sfax is expected to deliver around 110,000 tons, Sidi Bouzid 80,000–90,000 tons, and Kairouan and Gafsa about 55,000–60,000 tons each. National output is estimated between 450,000 and 500,000 tons, with high quality anticipated.

In Morocco, forecasts suggest production of roughly 240,000 tons, up from an average of 160,000–180,000 tons.

In Turkey, after last year’s record crop, adverse weather, a hot April and prolonged summer drought, could reduce production to 150,000–170,000 tons.

Portugal expects steady yields thanks to groundwater access, irrigated groves, and strong performance from traditional rainfed areas, potentially reaching 180,000–200,000 tons, surpassing last year’s levels.

Compared with the prior season, the new estimates reaffirm Spain’s leading role in global production and underscore Tunisia’s advancement to the world’s second-largest producer by volume, taking Italy’s place. Turkey normalises after last year’s record output, and Greece continues its recovery, narrowing the gap with Italy.

An article published on October 16 by another Spanish magazine Olimerca, highlights that the primary concern for the upcoming Mediterranean harvest may be the quality of the output, rather than the volume.

The report notes that continued dryness in Spain and Portugal could, if prolonged over the next few weeks, negatively impact olive fruit quality, with potential effects on the flavor and classification of extra virgin olive oil.

To quote: “Now the harvest volume matters less, whether it will be above or below the estimate by the Junta de Andalucía and the MAPA; the problem now will be quality, which is the key factor to drive our trade, both domestic and international. The availability, or scarcity, of high-quality extra virgin olive oil from Spain, the world’s largest producer, will have a direct and cascading impact on market prices across other origins.”

Tunisia: Major Challenges Ahead Despite Record Highs

This month, Tunisia has been prominently featured in the international press, not only for its strong production outlook, estimated between 400,000 and 500,000 tons for the 2024/25 crop year, but also for the structural challenges affecting its olive oil industry, which is also made of approximately 300,000 olive oil producers (mostly small family operations).

An article published earlier this month by Olive Oil Times reported that, despite the record harvest, export revenues declined by 28.9% to approximately €715.5 million, even as export volumes rose by 40.1%. This sharp fall in value highlights a collapse in average export prices, raising concerns about the sector’s profitability.

At the same time, the Italian trade publication Teatro Naturale (October 4) published an investigative report highlighting growing concerns over fraudulent triangulations of Tunisian olive oil exported indirectly through Spain and other EU countries in 2025. The investigation revealed that significant volumes were reportedly resold well below Tunisia’s official minimum export price of €3.40/kg, undermining transparency and distorting market competition. According to the report, these transactions, estimated at more than €180 million, have prompted criticism from Italian industry and farming associations such as Coldiretti and UNAPROL, which are urging tighter traceability and stronger enforcement throughout the Mediterranean supply chain, following the model of Italy’s SIAN system.

Both reports converge on a central issue: while Tunisia’s production performance remains strong, irregular trade practices and sharp price undercutting threaten the well-being of Tunisian farmers as well as the stability of the country’s olive oil sector.

In response, Tunisian President Kaïs Saïed has reiterated the need to reinforce institutional oversight through the National Olive Oil Board, while expanding support to small-scale farmers and promoting greater value capture within Tunisia. He also urged comprehensive improvements along the production chain, from cultivation and harvesting to processing and export management.

Ultimately, Tunisia’s olive oil industry enters 2026 with three key challenges ahead: maintaining high production levels, ensuring market integrity, and adapting to shifting international trade conditions. The United States, one of the largest buyers of Tunisian olive oil, has imposed a 25% tariff on these imports in July 2025, a measure that adds pressure to export margins. Sustaining competitiveness will depend on balancing strong output with transparent and fair trading practices to maintain confidence in North African supply origins, as well as finding the right trade partners.

Final Thoughts

The olive oil market now stands at a pivotal stage, with the new harvest just around the corner.

While many traders anticipate a downward correction in prices once fresh oil reaches the market, the outcome remains uncertain. Weather conditions across much of the Mediterranean continue to be dry, and the absence of significant rainfall could lead to notable quality issues.

Under these circumstances, it is prudent not to rely solely on early harvest volume forecasts to make judgment calls on value trajectories. The decisive factor will be the availability of high-quality extra virgin olive oil, particularly for operators focused on middle to premium quality segments.

Producers remain reluctant to reduce prices substantially, given ongoing climatic challenges, trade instability, rising energy costs, and production risks. In Spain, the agricultural organization UPA (Union of Small Farmers and Ranchers) has described the conclusion of the 2024/25 campaign as “disappointing.” Despite record production of over 1.4 million tons and a 38% increase in exports, UPA noted that some market participants pushed prices at origin below production costs, preventing fair value distribution across the supply chain and putting further pressure on traditional growers’ profitability.

Against this backdrop, and with Spain expecting a slightly lower harvest, it remains to be seen how the market will absorb the arrival of new-crop oils, particularly from Tunisia and Italy, and whether any significant price realignment will occur in the first quarter of the new campaign.

For tailored market insights or to explore strategic opportunities in private-label olive oil, please contact our international sales and product development team by email or come see us at the next PLMA show in Chicago, booth F2613.

International Olive Council

Olive Oil Times,

Mercacei,

Poolred,

Ismea Mercati,

Junta de Andalucia.