New Harvest Outlook: Impact on Valuations

7 MIN READ

By Franziska Finck — November 26, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to

support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s Happening This Month?

The new harvest is underway across the Mediterranean. In Portugal, Tunisia, Spain, and Italy, most mills are now fully operational.

The hot, dry autumn in Spain, the world’s largest olive oil producer, has lowered initially optimistic production expectations, helping keep the market firm despite the arrival of new-season volumes. Currently, prices for high-quality, traceable extra virgin olive oils from Spain are trading at approximately 5 Eu/Kg, with a 0.50 Eu/Kg premium for certified organic EVOO.

Italy is experiencing an unexpected decline in extra virgin olive oil prices, particularly in the southern regions where most of the country’s production is concentrated. This drop follows two years of relatively stable, elevated price levels, raising concern within the local industry.

According to the Bari Chamber of Commerce, mill-gate prices in Puglia decreased from 9.30 Eu/Kg to 7.40 Eu/kg over 3 weeks. A decline in average evaluations of roughly 20%.

In Greece, concerns are rising over the quality of early oils, driven by high acidity linked to continued drought and olive fruit fly pressure. Conventional olive oil is trading at an average of 4.90 Eu/Kg, while organic olive oil stands at 5.70 Eu/Kg.

Tunisia has begun what is expected to be a record volume harvest, with early oils showing good quality. Prices have eased compared to previous months, now at around 3.70 Eu/Kg for conventional and 3.95 Eu/Kg for organic.

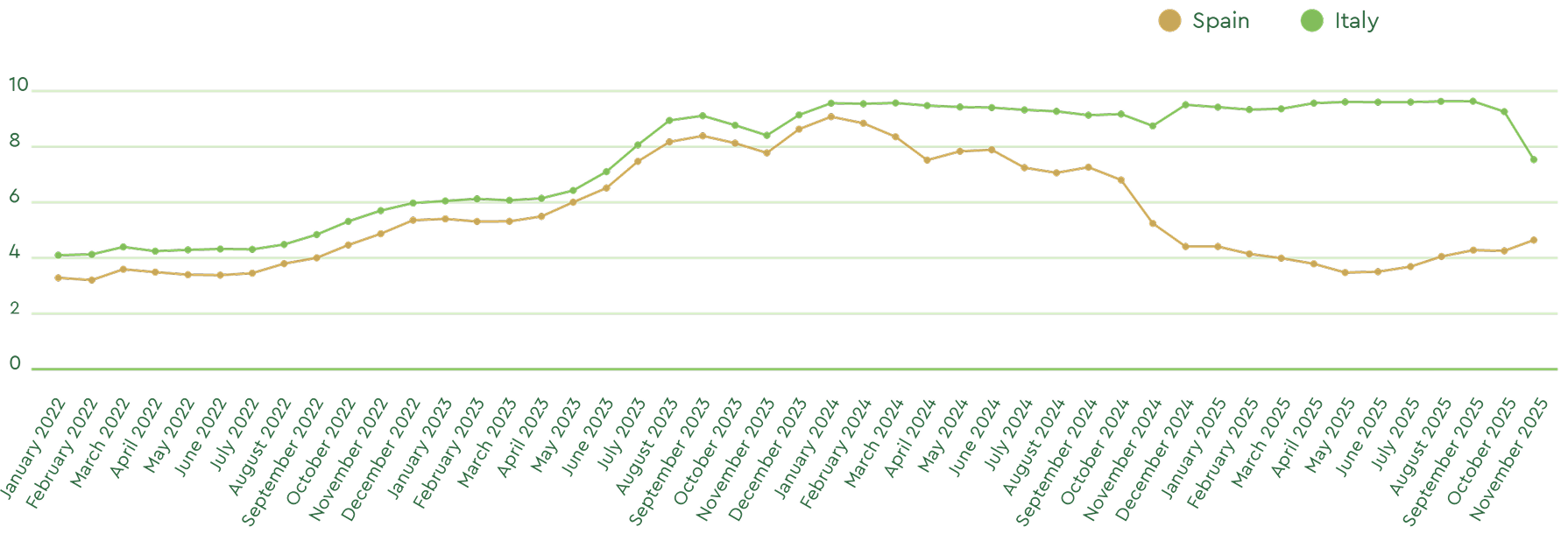

Overview of the most recent figures reported by official market sources:

** Note: Reported prices are averages across multiple quality grades; premium, clean, pesticide-free extra virgin olive oil typically trades at higher values.

Extra Virgin Olive Oil

Price Evolution

Sources: Poolred, Ismeamercati.

Spanish Volume Balance Sheet: Entering the new Crop Year 2025/26

The new harvest cycle in the Iberian Peninsula began in October, bringing volumes of fresh extra virgin olive oil (EVOO) to trade markets, both local and international.

Reports on the start of the harvest vary: some note a stable beginning, while others cite an excellent commercial kickoff. According to provisional figures from AICA (Agencia de Información y Control Alimentarios, Spain’s Food Information and Control Agency), roughly 130,000 tons of transactions—including imports—have been recorded, aligning with last year’s levels.

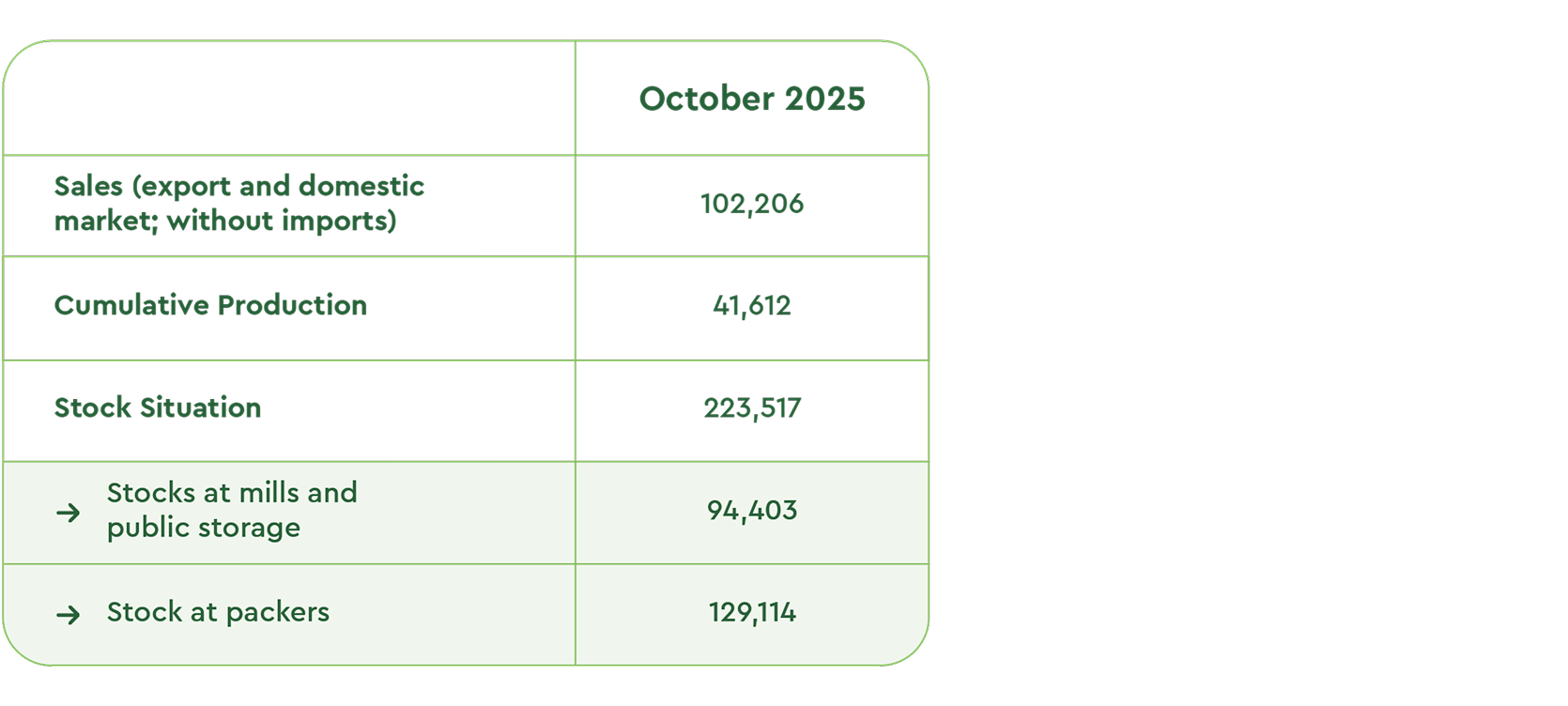

Spain has produced 41,612 tons so far, including 27,639 tons from Andalucía, the country’s largest producing region. This represents a 20% increase compared to the previous year. Some analysts had expected higher volumes, but those projections were reduced due to insufficient rainfall and unusually high temperatures.

Interest in Spanish olive oil remains strong despite limited overall availability, allowing the local market to maintain the positive momentum seen last year.

Current stock levels stand at 223,517 tons, distributed as follows:

Key Figures of the Olive Oil Market (October) (in Tons)

While the official harvest year begins in January, the core of Spain’s harvesting and processing activity takes place in November and December, when most mills reach full operational capacity. These two months typically define the shape of the entire campaign, as the majority of volumes are produced during this concentrated period.

As production ramps up, more reliable data will become available, allowing a more precise assessment of total output and regional performance. Based on current field observations and early milling results, a further reduction in production this season appears unlikely, provided weather conditions remain stable throughout the remainder of the harvest window.

Italy’s Olive Oil Market Focus: Rising Stocks Amid Sharp Price Decline

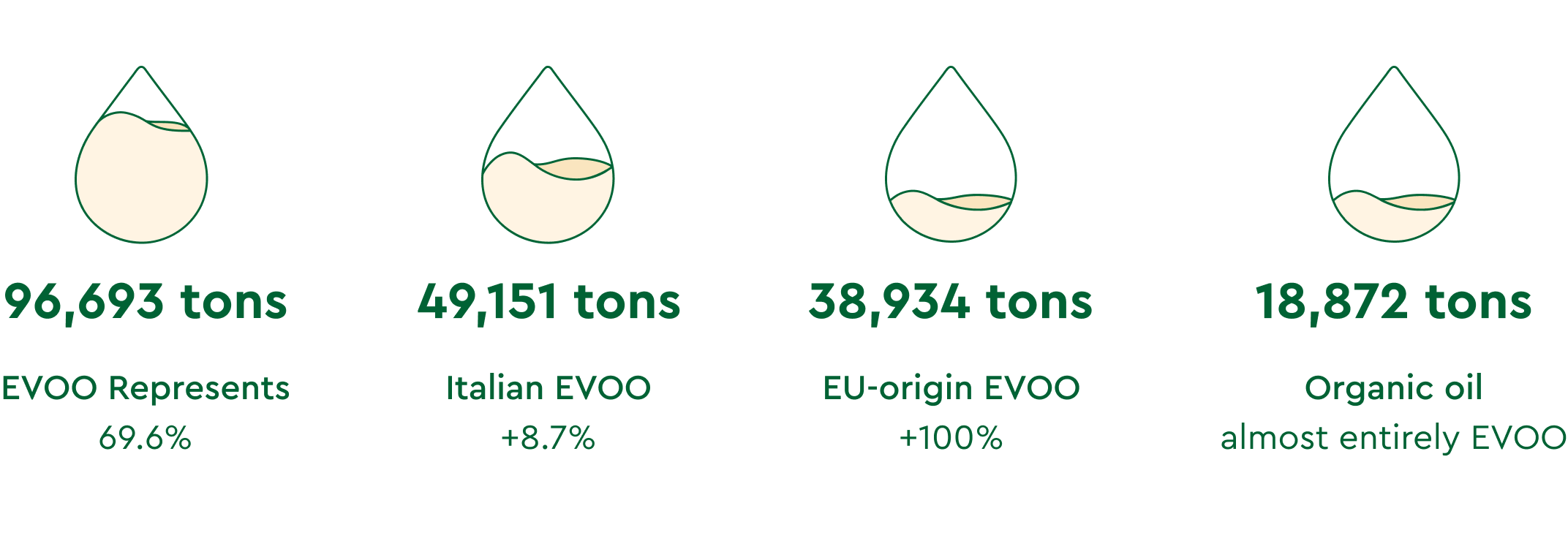

Italy has recently seen a sharp decline in olive oil prices, contrasting with the strong upward trend of 2022–2024, when drought-driven shortages and higher production costs pushed valuations to historic highs. Against that three-year backdrop, the correction observed in late 2025 appears larger than current supply conditions alone would justify.

Sector organizations have raised concerns about the impact on producers and are calling for a national olive oil roundtable. Some operators note that the speed of the decline resembles a bubble-type correction, in which prices fall more rapidly than fundamentals suggest, suggesting possible speculative or short-term pressures.

A recent article in a leading Italian Olive Oil trade magazine, Teatro Naturale, highlighted concerns about the dynamics behind the rapid price drop, noting that the 6.3 Eu/kg listing reported by Ismea Mercati (Istituto di Servizi per il Mercato Agricolo Alimentare—Italy’s Institute for Services to the Agricultural and Food Market) on November 13 was viewed by many producers as “a slap in the face for Italian olive growing sector.”

The article also points out that premium and origin-certified EVOOs such as DOP Terra di Bari and IGP Puglia remain stable at 8.5 €/kg, underscoring the gap between current market prices and underlying production costs.

Italy is known not only for its high-quality extra virgin olive oil and for hosting some of the sector’s most influential companies. Several major Italian brands, many owned by Spanish groups, handle large volumes of Mediterranean raw materials and market them under well-established Italian labels. This gives Italy a key commercial role in the global olive oil trade, extending beyond its own production and local consumption.

According to the Frantoio Italia stock report, Italy held 138,982 tons of olive oil on October 31, 2025, an increase of 32.7% year-on-year.

Stock situation: 138,982 tons

31.10.2025 (+32.7% compared to 2024)

Southern regions hold 46.8% of total stocks (Puglia 22.9%, Calabria 13.7%)

FAO Olive Oil Analysis: Production Down, Consumption Up

The Spanish trade magazine Mercacei reported this month on a FAO (Food and Agriculture Organization of the United Nations) study examining harvest forecasts, consumption trends, and broader market dynamics.

FAO forecasts global olive oil production at around 3.4 million tons for the current 2025/26 campaign, slightly below last year.

Spain will remain the top producer, accounting for roughly 40% of world output, while Tunisia is projected to reach close to 500,000 tons, becoming the second-largest producer. Italy is expected to recover after last year’s drought, reaching 300,000 tons while Greece and Turkey may see declines due to weather-related variability.

Global consumption is projected to rise as prices ease from the highs of 2022–2024.

Global trade is expected to exceed 1.3 million tons, with the EU and Spain maintaining a pivotal position. Higher U.S. tariffs, currently between 15% and 25%, may temper export flows and slow market expansion in the United States.

Strong output in Tunisia and reduced volumes from Turkey are expected to influence trade flows.

Climate risks, including irregular rainfall, drought, and high temperatures, remain key challenges in FAO’s assessment, while rising production and labor costs continue to pressure smaller producers.

Stable trade relationships, consistent regulation across trading markets, and strict quality standards will be essential to maintaining long-term confidence.

Final Thoughts for 2026 Procurement

The new harvest will expand rapidly in the coming months, helping rebuild low stock levels. In Spain, about 90% of mills are already operating, with peak activity expected through November and December. With few contracts secured for 2026 so far, the coming weeks will likely see retailers locking in supply for January–June.

Despite increasing availability, prices remain firm. Cooperatives continue to release limited volumes, supported by solid demand and expected growth in consumption. In Italy, even after a ~20% price drop, producers are calling for prices that reflect real production costs.

Tunisia’s record harvest is also shaping market sentiment. Ongoing scrutiny of pricing practices and legal developments involving a major exporter adds uncertainty at a time when Tunisia is set to play a central role in the 2025/26 balance.

As production advances across origins, visibility should improve and pricing is expected to align more consistently. This period will be critical for defining early-2026 supply conditions. Buyers should track origin dynamics closely—especially Spain’s firm prices and Tunisia’s large crop under heightened attention. Early contracting remains advisable, with price flexibility still limited across most origins.

Diversifying supply, securing traceable volumes, and working with reliable long-term partners remain key to managing volatility. Precise quality standard strategy and planning are essential amid ongoing climate and cost pressures.

To support your 2026 sourcing strategy, Certified Origins invites buyers and industry partners to contact our team to structure dependable, value-aligned supply programs tailored to your needs.