Solid Demand, Prices Decline, and Trade Policy: Can Producers Sustain the Pressure?

5 MIN READ

By Franziska Finck — May 26, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to support your private label retail strategy.

Want it monthly?

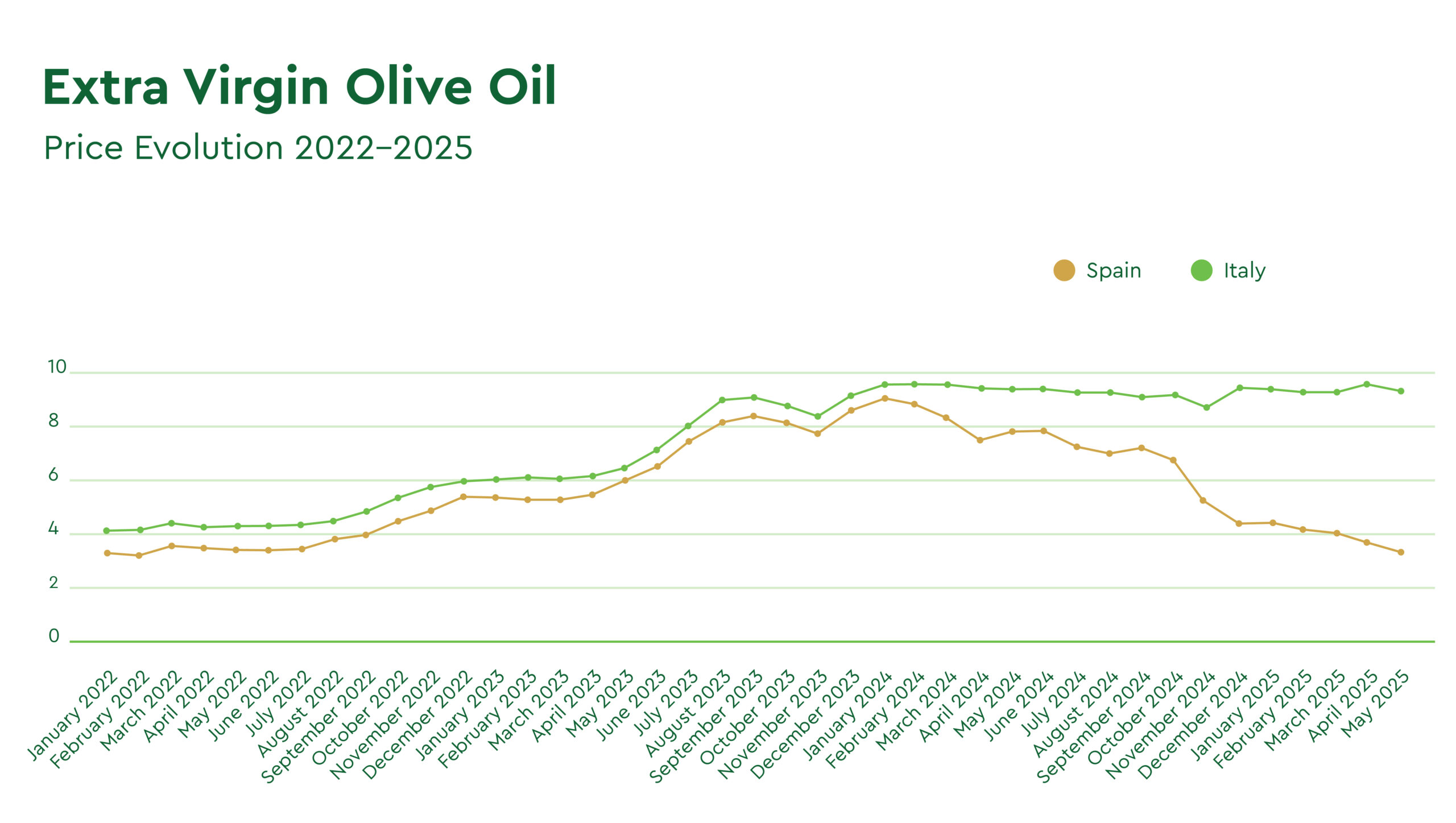

Sign up hereOlive oil market prices continued their downward trend in May, primarily driven by favorable weather and rainfall across major growing regions. These conditions improved expectations for the 2025/26 harvest, contributing to an additional softening of prices across producing countries, except for Italy, due to its limited stock levels.

As of May 23rd, reference market prices indicate the following:

Source: Poolred (23.05.2025), Ismea (third week of May, 2025)

While these official figures reflect an average across various quality grades, actual transaction prices, particularly for high-quality extra virgin olive oil, are notably higher. As premium olive oils become increasingly scarce, their values have shown greater resilience against the overall downward trend.

With flowering nearing completion, agronomic indicators in early June will provide greater clarity on harvest volume potential.

U.S. Olive Oil Imports and Trade Policies

Global demand remains stable, anchored by the U.S. market, which continues to play a central role in international trade for health-oriented products such as olive oil. According to data reported by Olimerca from the International Olive Council (IOC), the United States imported 99,033 Tons of olive oil between October 2024 and February 2025, up 7% year-on-year, with an import value of approximately 768.6 million Euros (829.7 million USD).

The European Union remains the top supplier of olive oil to the United States, delivering over 252,000 Tons annually. After a sharp 25.7% drop in volume during the 2022/23 season, EU exports to the U.S. rebounded in 2023/24, reaching 228,423 Tons. This recovery was accompanied by a 64.6% surge in export value, rising to 2.08 billion euros (approximately $2.25 billion USD).

Export prices peaked at 9.88 Eu/Kg in July 2024 but dropped to 6.68 Eu/Kg by February 2025. While this marked a significant decrease from the peak, prices remained above previous-year levels.

According to the International Olive Council (IOC), the average EU export price to non-EU markets for all grades fell to 6.47 Eu/Kg in February 2025—a 31.9% year-on-year decline. Extra virgin olive oil continued to trade at a premium, averaging 6.96 Eu/Kg. Despite the price drop, EU exports to non-EU markets increased by 20.8% to 65,044 Tons, with extra virgin olive oil accounting for 72.3% of total volumes.

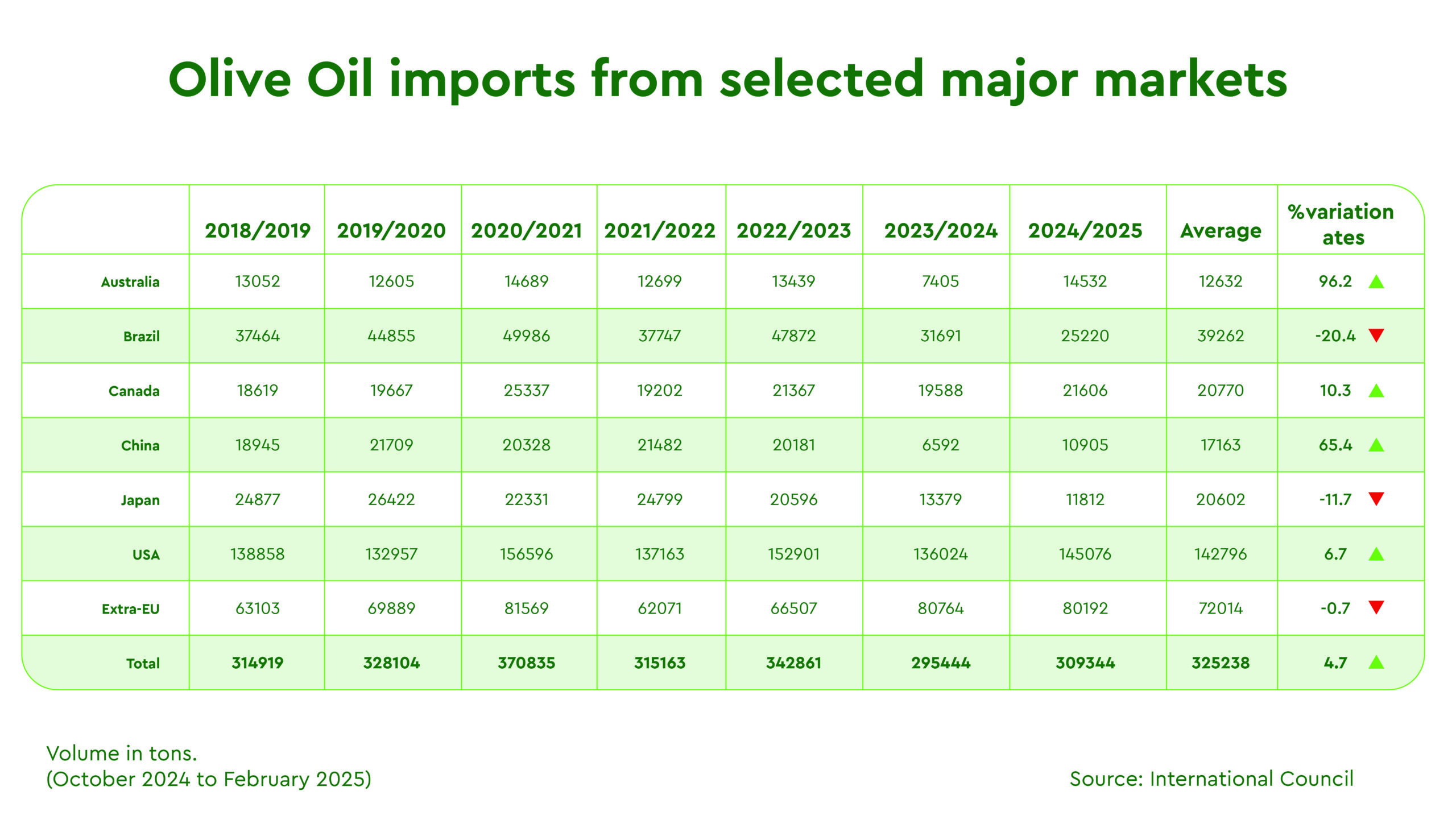

On the import side, global volumes into the U.S. from October 2024 to February 2025 grew by 4.7%, reaching 309,344 Tons. Significant increases were recorded from Australia (+96.2%), China (+65.4%), Canada (+10.3%), and the USA (+6.7%), while imports from Brazil and Japan declined by 20.4% and 11.7%, respectively.

Industry observers note that the sharp rise in early 2025 U.S. import volumes may be partially driven by anticipatory buying behavior. Importers could be ordering additional stock ahead of potential policy shifts, including the expiration of the current pause on tariffs and the possible implementation of newly announced duties of up to 50% on olive oil imports from Europe.

With over 95% of U.S. olive oil supply sourced externally—primarily from the Mediterranean—any tariff increase could have a substantial impact on cost structures for American buyers and retailers. The risk of rising costs is compounded by the timing of future policy decisions, which remain unclear and continue to inject volatility into long-term procurement planning.

With protectionist trade agendas resurfacing in U.S. policy discussions, uncertainty over future tariffs clouds the global consumption outlook. Despite this, strong underlying U.S. demand for healthy and natural ingredients keeps olive oil trade volumes resilient.

Spain’s Balance Sheet and Price Pressure

In April 2025, Spain’s olive oil sector demonstrated robust performance, with total sales reaching 117,034 Tons across domestic and international markets. Although this figure represents a slight decrease from March, it underscores sustained demand, bolstered by continued low farm-gate prices. Including imports, the total market supply for the month is estimated at approximately 132,000 Tons.

Final production for the 2024/25 season was 1,410,494 Tons. As of April 30, stocks stood at 881,758 Tons:

- 666,458 Tons held by mills

- 205,465 Tons held by packaging companies

If monthly sales continue in the 115,000–120,000 Ton range, stocks could tighten significantly by the end of September, potentially raising concerns about availability.

The recent decline in producer prices—down by over 50% year-on-year—has placed mounting pressure on Spanish farmers, particularly in key regions such as Andalucía. Despite strong sales volumes, many producers report struggling to cover basic production costs, raising concerns about the long-term sustainability of small and mid-sized farms. The mismatch between rapidly falling wholesale prices and slower retail price adjustments has further strained profitability across the supply chain.

Looking ahead, the outlook for the 2025/26 harvest is cautiously optimistic.

While it’s too early for definitive forecasts, these conditions suggest a potential return to average historical production levels, offering hope for a more balanced market in the next season.

FINAL THOUGHTS

The olive oil market remains active, supported by stable global demand and competitive prices. From a buyer’s perspective, short-term availability is not an immediate concern, except for Italy and high-quality origins, which remain priced at a premium.

However, producers face mounting strain. In Spain, farm-gate prices have dropped over 50% year-on-year, leaving many unable to cover production costs. The disconnect between wholesale declines and slower retail adjustments continues to pressure margins, particularly for small and mid-sized farms.

Trade policy uncertainty adds further risk. U.S. importers may be building inventories ahead of potential tariff hikes. With over 95% of the U.S. supply imported, mainly from the Mediterranean, any increase in duties could sharply raise sourcing costs and shift sales trends towards seed oils.

While favorable weather hints at a return to average production in 2025/26 in Spain, a sustained recovery in farm-level compensation is expected. Without it, producer viability may become the market’s most pressing issue.

For further insights or tailored support, please contact our international team.

Back to Learn & Discover Back to Market Reports