Olive Oil Market Report – May 2024

The demand for olive oil is driving prices up once again.

What’s happening this month?

At the beginning of April, in Spain, Olive Oil bulk prices fell sharply, with peaks of 10%, due to the news of abundant rain and hopeful harvest expectations for the next crop.

In an increasingly fast-paced trading world, market fluctuations have driven the cost of many other origins down, increasing pressure on traders and producers to adjust their listings accordingly for a few weeks.

After a period of widespread optimism, the release of April data on Spanish exports and domestic consumption caused prices to halt immediately and reverse the downward trend.

The global olive oil stock is exceptionally low after two consecutive poor production seasons in Spain and other regions. This has occurred alongside a relatively unchanged consumption pattern, mainly for Extra Virgin Olive Oil grades.

Major retailers and traders in the industry are all asking the same question: “Will there be enough quality and quantity of extra virgin olive oil to meet the global demand until the next harvest begins?”

This fundamental question is causing market tension once again.

Here is a general market snapshot from May 23rd from various sources.

Spain: 8.06 Eu/Kg → +2.5% versus the previous week (Poolred)

Italy: 9.45 Eu/Kg → + 1% versus the previous week (Ismea)

Greece: 8.08 Eu/Kg → +1.5% versus the previous week (Ismea)

Tunisia: 7.63Eu/Kg → +0% versus the previous week (Ismea)

Sources: Poolred, Ismeamercati

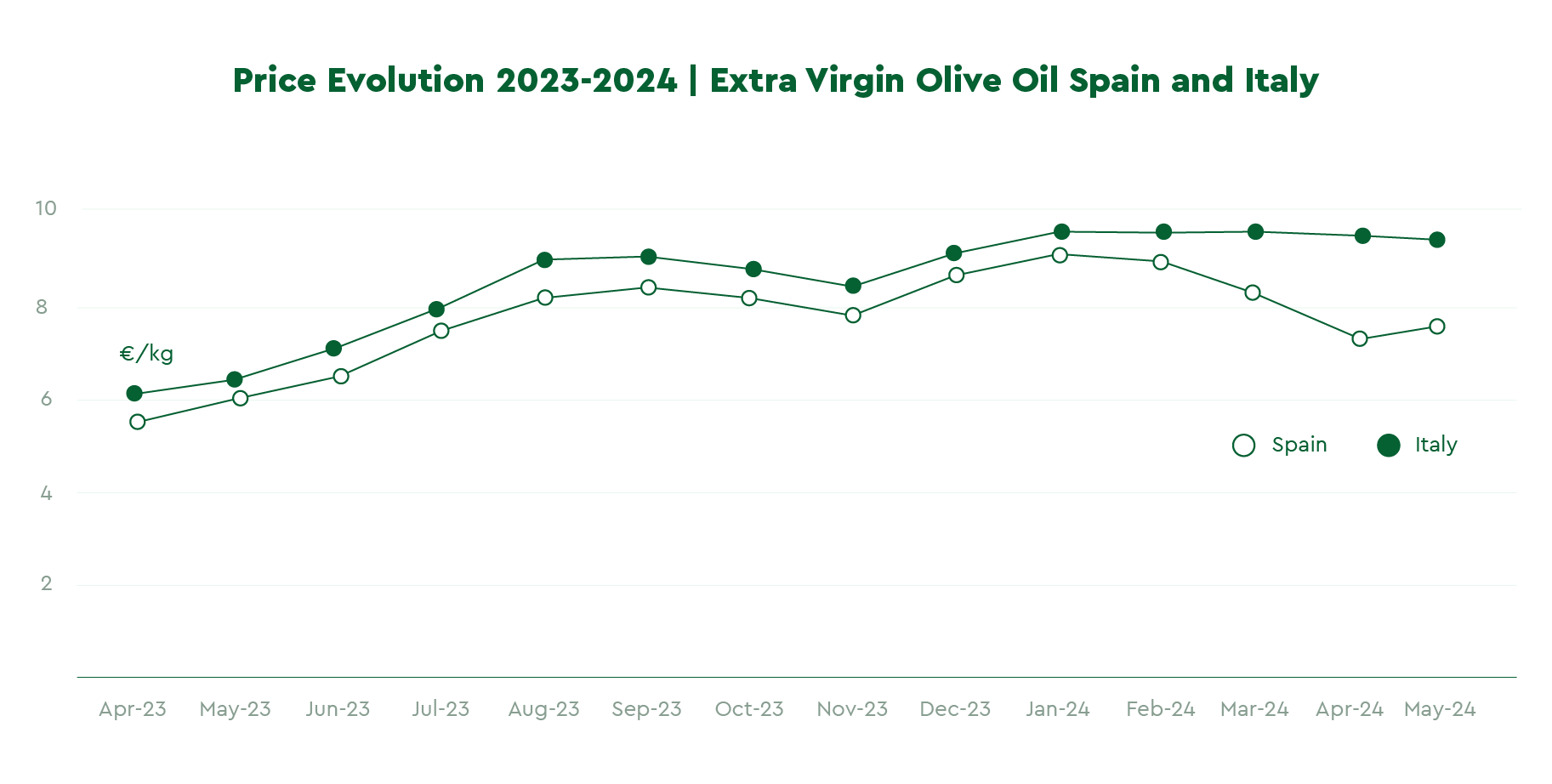

Poolred, the primary platform for monitoring olive oil trade in Spain, reported that the average price for Extra Virgin olive oil was 8.33 EU/Kg in March, 7.51 EU/Kg in April, and reached nearly 8 EU/Kg again in the second half of May.

Italian EVOO trade prices were also affected, albeit with minor fluctuations. The Italian ISMEA agency reports a drop from 9.52 Eu/Kg to 9.39 Eu/Kg in April, back to 9.45 Eu/Kg at the beginning of May. When the focus shifts from average trade prices to higher-quality flavor profiles and lower pesticide residuals, price fluctuations become less relevant, and prices remain substantially higher.

Our purchasing department has reported that the demand for quality extra virgin olive oil (EVOO) has remained relatively stable. Limited interest from cooperatives and traders in selling keeps driving the costs up. When available for trade, the average premium for quality oils is 0.20 Eu/Kg and even more for organic oils.

Spain’s stock balance in detail

Spain released 102,000 Tons of olive oil in April, including exports, domestic market sales, and imports. This official figure represents the second strongest month since the beginning of the crop year and is 8% above the average of around 94,000 Tons from October to April. According to the Olive Oil Times, Spain’s monthly consumption and exports should be at most 90,000 Tons monthly to maintain the current stock until the next crop year.

After the latest data published by the Ministry of Agriculture, Fisheries, and Food, Spain reports the following stock situation:

• Individual owners: 2,232 Tons

• Industrial packer: 176,936 Tons

• Cooperatives: 397,722 Tons

Total stock: 576,890 Tons.

Compared to the already meager figures from the previous year, this year’s stock in April 2024 is 5% lower than Spain’s available in April 2023 (608,000 Tons). This data becomes even more surprising if we consider that Spain reported a 28% increase in production this year compared to April 2023 (April 2024: 850,000 Tons versus April 2023: 661,000 Tons).

About 70% of the Spanish olive oil reserves are currently held by cooperatives. These collective entities will now be responsible for managing the demand in the coming months. The Jaen region in Andalusia reports the highest amount of olive oil available, followed by the province of Córdoba with 74,303 Tons and Seville with 42,787 Tons.

The industrial sector has probably already sold or contracted many of its olive oil reserves. According to Olimerca, approximately 6% of the 176,963 Tons (30,000 Tons) have already been packaged, while the rest is still in storage.

Inventory Situation in Italy

A report published on May 20 by the Italian Ministry of Agriculture suggests that Italy will also face a lack of inventory before the end of the year.

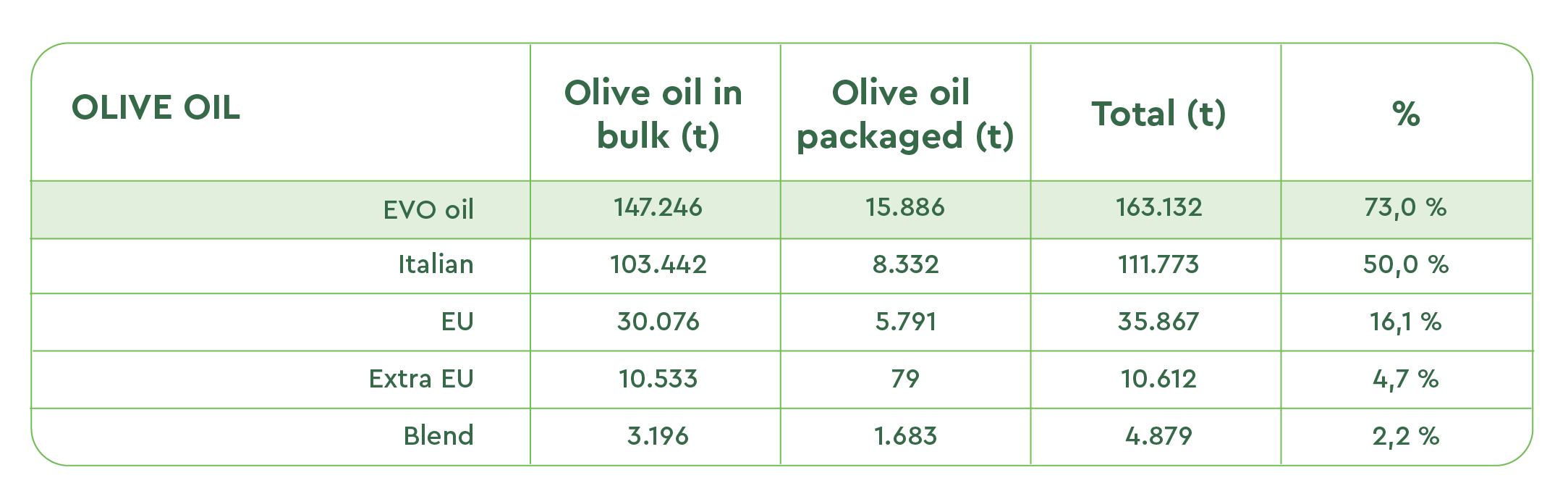

According to the data, as of the end of April, Italy had a total stock of 223,409 Tons, which represents a decrease of 8.0% (242,803 Tons) compared to the end of March 2024 and a 23.8% decrease compared to the same period last year. Of the 223,409 Tons, 73% (163,132 Tons) is Extra Virgin Olive Oil, with 68.5% (111,773 Tons) of Italian origin.

Currently, 147,246 Tons of Extra Virgin Olive Oil are stored in bulk in Italy, 19% less than the quantity from last year. The math suggests that Italian producers should release at most 30,000 each month to arrive in good standing for the new harvest.

Table 1. Olive oil stocks in Italy by category and origin

Overall, we are entering a complex phase regarding the availability of Extra Virgin Olive Oil. The adverse and extreme climate conditions experienced in the Mediterranean area have, in fact, affected both the quantity and the quality of the oil.

In early May, the stock of olive oil in the Mediterranean basin was estimated at 1,150,000 Tons, with only about 34% being Extra Virgin Olive Oil and the rest comprising lower grades. This number sharply contrasts with a global demand estimated at around 60%.

The scarcity of high-quality olive oil from Europe is expected to result in a greater need for premium olives from other producing nations. This situation will open up opportunities for emerging export players in the Mediterranean region, including Morocco, Tunisia, and Turkey.

These countries might invest in their supply chains to meet global demand and compete more effectively with traditional producers such as Spain, Italy, Greece, and Portugal in the years to come.

Final Thoughts

Trade and retail prices may remain high until September/October, coinciding with the start of the new harvest. Prices are expected to decrease as new oils flow into tanks and the market from the mills across the Mediterranean unless unforeseen weather events affect the trees and fruits in the major producing countries.

Spain’s water reservoirs have been replenished by recent rainfall. The country is expected to surpass the 1 million mark again after two challenging harvest years for most rain-fed olive groves.

Other Mediterranean countries expect a good result except for Italy, which could have a lower harvest. Some experts predict that global production will exceed 3 million Tons in 2024/25, indicating general optimism in the sector.

Please visit us at the PLMA show in Amsterdam, Hall 8, G51, or contact us directly by email. Our team of experts will work with you to help you navigate these challenging times and grow your Extra Virgin Olive Oil programs.

Back to blog