Procurement Stress:

Olive Oil Stock Constraints and Trade Pressures Intensify

5 MIN READ

By Franziska Finck — July 22, 2025

Our Monthly Olive Oil Market Report blends real-time data with field insights to

support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s happening this month?

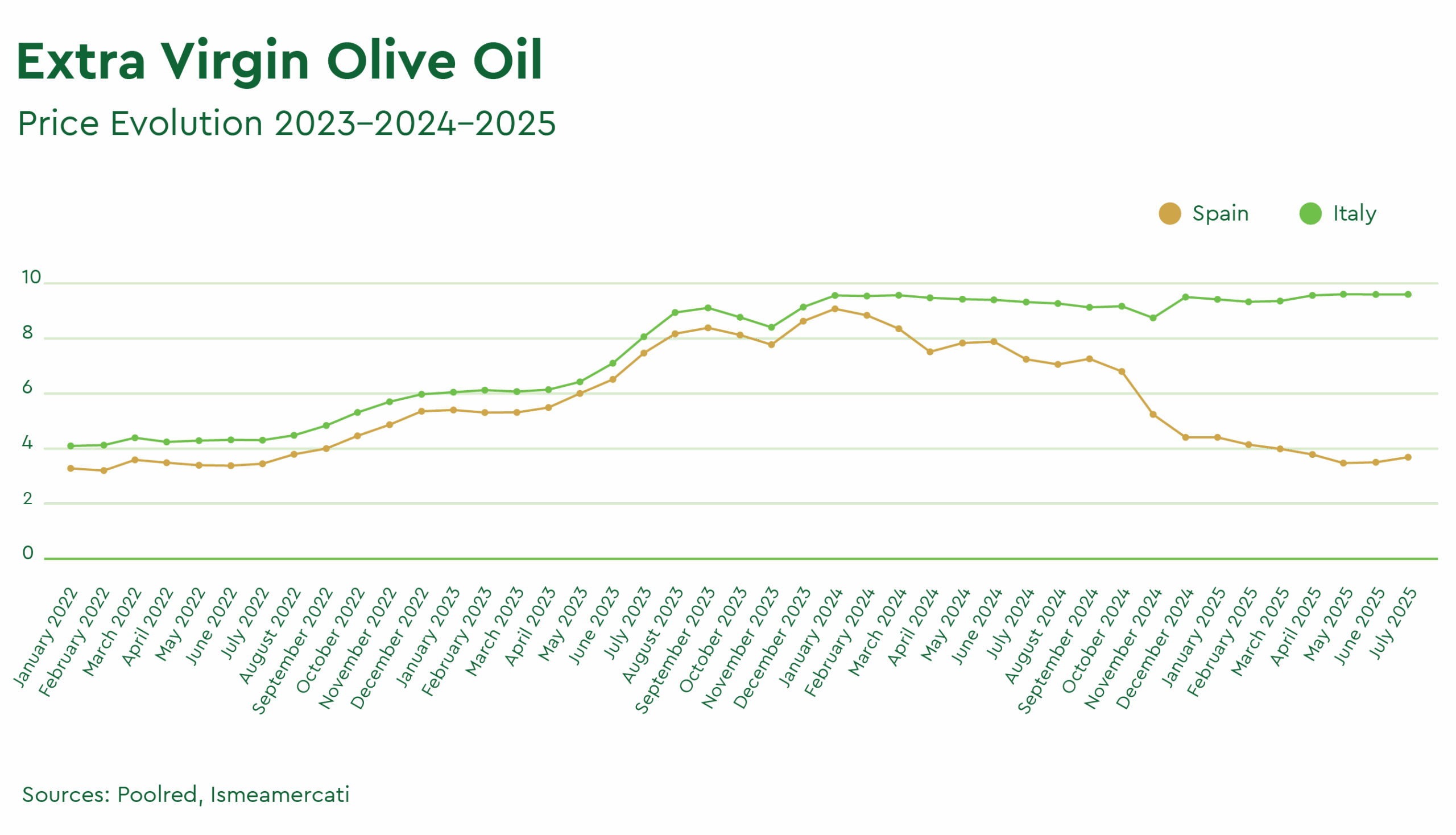

The olive oil market in July continues to follow the trajectory observed in previous months. Italy continues to uphold elevated price levels, supported by limited inventories and steady demand for premium-grade oils. In contrast, the broader Mediterranean region has seen price stabilisation following significant earlier-year declines, with marginal upward adjustments now emerging in some local markets.

Two main converging factors drive this moderate upward pressure. The unusually high temperatures in Spain during late June and early July have raised serious concerns about the physiological stress on olive trees during a critical phase of fruit development, potentially compromising both yield quantity and fruit quality in the upcoming harvest. As a result, crop forecasts for the 2025/26 campaign have been revised downward by approximately 10% so far. At the same time, robust June sales have further depleted the volumes of available stock on the trade market.

In other key producing countries such as Greece and Tunisia, the persistent summer heat is also exacerbating supply constraints. As stocks tighten across the Mediterranean region, which is responsible for over 80% of the global supply of Olive Oil and Extra Virgin Olive Oil, players are becoming more cautious in releasing volumes into the market, and price trends are reflecting a growing sense of uncertainty.

A review of current market price indicators confirms these developments, providing a detailed picture of specific regional dynamics.

** please note: while these official figures reflect an average across various quality grades, actual transaction prices, particularly for high-quality extra virgin olive oil, are notably higher.

Mediterranean Exports Towards the U.S. at Risk as New Tariffs are Announced

Adding another layer of complexity for U.S. food retailers and both local and global olive oil stakeholders, the industry was shaken this month by the U.S. President’s announcement of a flat 30% tariff on agricultural imports from the European Union, tripling the existing 10% import tax, and a 25% rate on products from Tunisia, both set to take effect on August 1.

The announcement triggered widespread concern across the EU, particularly over core components of the Mediterranean diet that enjoy strong U.S. demand and longstanding trade ties, such as cheeses, wines, spirits, and notably olive oil, one of the region’s most strategically significant agricultural exports. Spain and Italy, in particular, are alarmed, recognising that any erosion of market share in the U.S., a key export destination, would be difficult to offset through alternative markets.

In response, numerous European policymakers, along with farming and producer associations, are calling for a unified EU stance and urging continued constructive dialogue with the U.S. administration. While trade uncertainty and concerns over major export disruptions persist, there is still hope that a diplomatic resolution can be reached before the tariffs take effect on August 1.

According to a recent article published by the Spanish magazine Olimerca, the value of olive oil imports from Europe to the United States rose by 25% between January and May 2025 compared to the same period in 2024, and by 35% to 2023.

This notable increase suggests that many European producers and U.S. importers may have strategically front-loaded shipments in anticipation of the announced U.S. tariffs, aiming to secure competitive pricing and inventory before the new trade barriers take effect.

New Horizons: Brazil Emerges as a Promising Market for Olive Oil

Amid escalating political tensions, the approval of new free trade agreements, and growing efforts by international businesses to diversify market access, Brazil is emerging as a strategic growth opportunity for olive oil exports.

A recent Mercacei report positions Brazil among the top global importers and consumers of olive oil, although per-capita intake remains low, just 0.34 liters in 2024, indicating untapped potential.

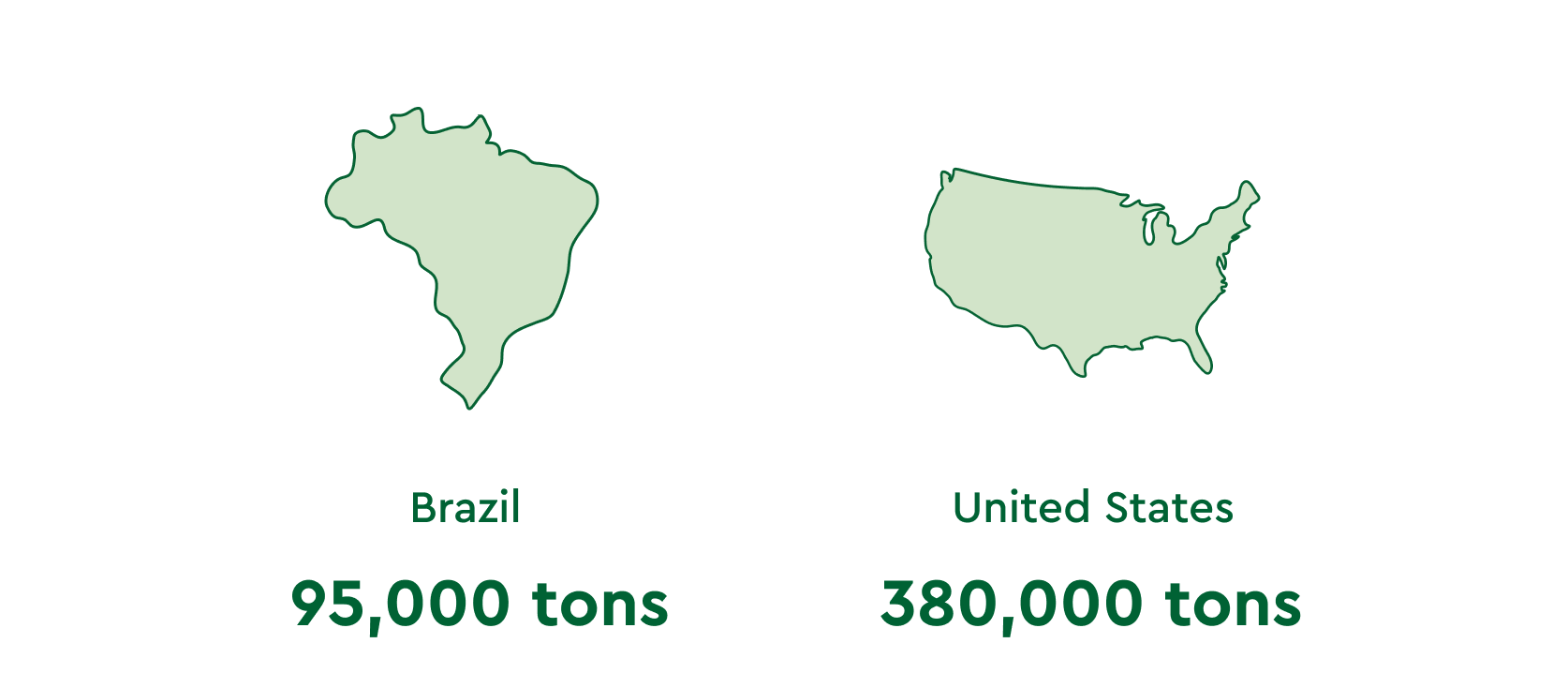

For context, Brazil’s annual olive oil imports average approximately 95,000 tons, about one-quarter the volume imported by the United States, which stands at around 380,000 tons, according to data from the International Olive Council.

According to Euromonitor, Brazil’s olive oil market is projected to grow at an average annual rate of 3% in value (cumulative growth of 16% by 2029) and 5.6% in volume (cumulative growth of 31%). Demand is supported by shifting dietary trends, particularly following the COVID-19 pandemic, and retailers are expanding their shelf space accordingly.

Portugal is currently Brazil’s leading supplier of olive oil, accounting for approximately 60% of total imports, followed by Spain with around 30%. Extra virgin olive oil represents an estimated 65% of total import volumes, based on the most recent available data. In 2025, Brazil eliminated import duties on all European olive oil grades, creating a fully liberalised import regime. These favourable trade conditions could be further strengthened if the new EU-Mercosur agreement is ratified, which is currently under review.

Brazil’s ongoing tax reform has the potential to reduce retail prices further, enhancing shelf accessibility. At the same time, local retailers are increasingly investing in private-label olive oil lines, opening new channels for European producers to expand their presence.

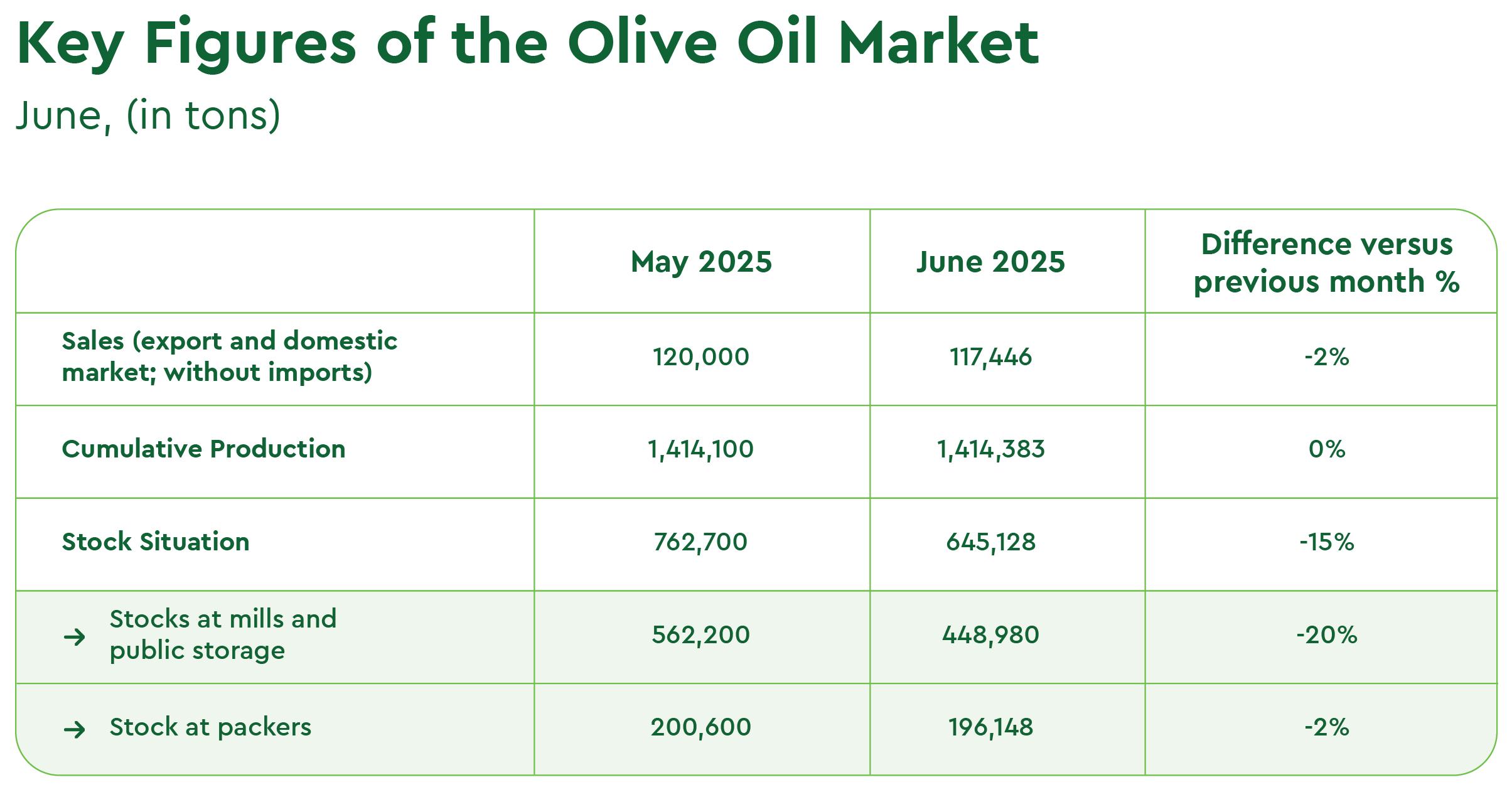

Spain’s Inventory Balance: June 2025

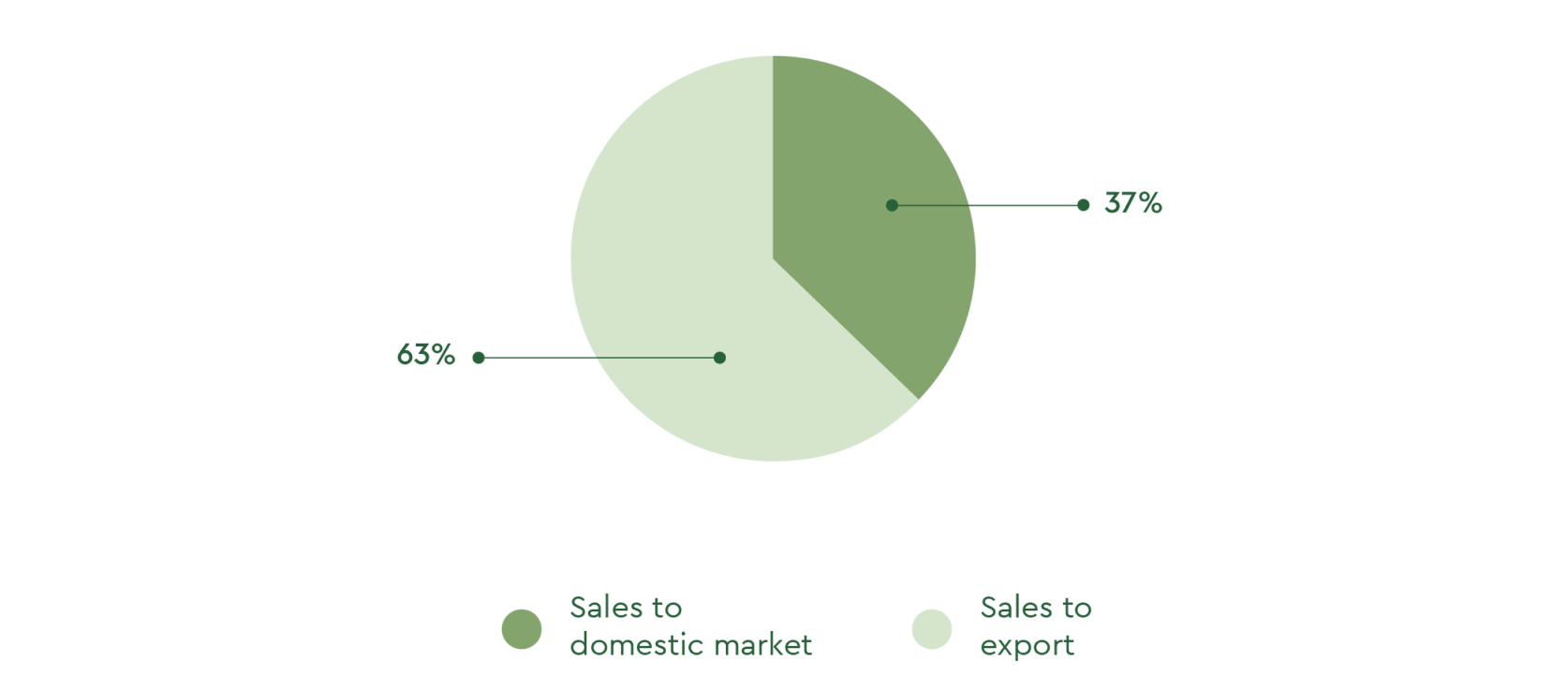

In June 2025, official figures from Spain reported cumulative olive oil production (all grades) of 1,414,383 tons for the 2024/25 campaign. During the month, 117,446 tons were released into the market, excluding imports. From October 2024 to June 2025, total sales reached 1,135,000 tons, equivalent to approximately 80% of total production.

By the end of June, total stocks stood at 645,128 tons, with 443,800 tons held in mills, 196,148 tons in bottling facilities, and 5,180 tons in the Communal Olive Heritage reserve.

Although slightly lower than in May, current sales volumes remain consistent with the five-month average, indicating stable demand. If this trend continues over the next three months, the projected end-of-campaign stock level is expected to fall to around 285,000 tons.

Final Thoughts

The U.S. tariff announcement has renewed uncertainty across the global olive oil market. While retail prices have not yet reacted significantly, strong U.S. demand continues to reduce inventories.

At the same time, extreme climate events in southern Europe are intensifying. Ongoing heatwaves in key producing countries are raising concerns about the 2025/26 harvest, with likely effects on both yield and quality. In this context, the price declines observed earlier in the year could have reached their floor and are expected to hold steady through the remainder of the current campaign.

Spanish and Mediterranean producers, especially in traditional farming regions, are signaling that current price levels at the source are unsustainable and no longer cover production costs. As a result, higher import duties, whether the current 10% or the proposed 30%, are likely to increase shelf prices, particularly in the U.S.

The impact of the existing U.S. 10% import tariff is likely to become more pronounced once pre-tariff contracts are fulfilled and new supply agreements reflect current tax rates and lower inventory levels, removing the cushion previously provided by earlier pricing structures.

Local and International olive oil brands and firms, many with significant private investments in promotion, domestic bottling, and storage infrastructure in North America, have collaborated closely with local retailers and chefs for decades to foster strong demand and establish the basis for a solid olive oil industry.

These same companies will now likely be facing the effects of rising import costs, a weakening dollar, and growing policy uncertainty, all of which could push prices higher throughout the supply chain.

For tailored market insights or to explore strategic opportunities in private-label olive oil, please contact our international sales and product development team.

Back to Learn & Discover Back to Market Reports