Rains Weigh on Spain’s Production. Policy Effect On Markets

7 MIN READ

By Franziska Finck — January 29, 2026

Our Monthly Olive Oil Market Report blends real-time data with field insights to

support your private label retail strategy.

Want it monthly?

Sign up hereWhat’s Happening This Month?

Harvesting activities are coming to an end in Italy, Greece, and Portugal, while they continue in Spain and Tunisia. In Spain, heavy rainfall has significantly disrupted farming operations, reducing the number of effective harvesting days and resulting in a lower overall volume of olives collected than initially expected, particularly in the Jaén region. In this context, Spain remains a particularly strong and stable market, with conventional Extra Virgin Olive Oil (EVOO) prices ranging from 4.50 Eu/Kg to €5.00 Eu/Kg and certified organic EVOO prices around 5.50 Eu/Kg.

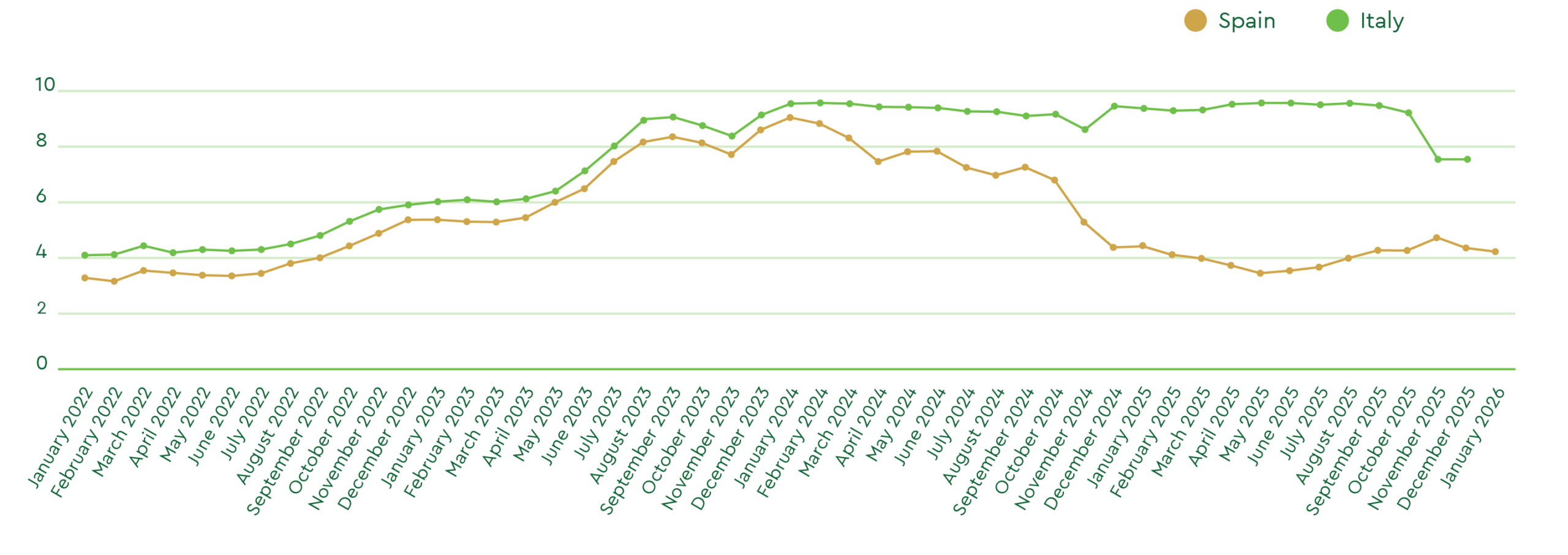

Tunisia and Portugal are increasingly positioning themselves below Spanish price levels, with Tunisian conventional olive oil at around 3.40 Eu/Kg and organic at 3.85 Eu/Kg. Italy’s olive oil prices, which have exceeded 9 Eu/Kg since 2024, have recently fallen to just under 7 Eu/Kg and have remained relatively stable over the past few weeks, with conventional olive oil valued at approximately 6.90 Eu/Kg and organic around 7.40 Eu/kg.

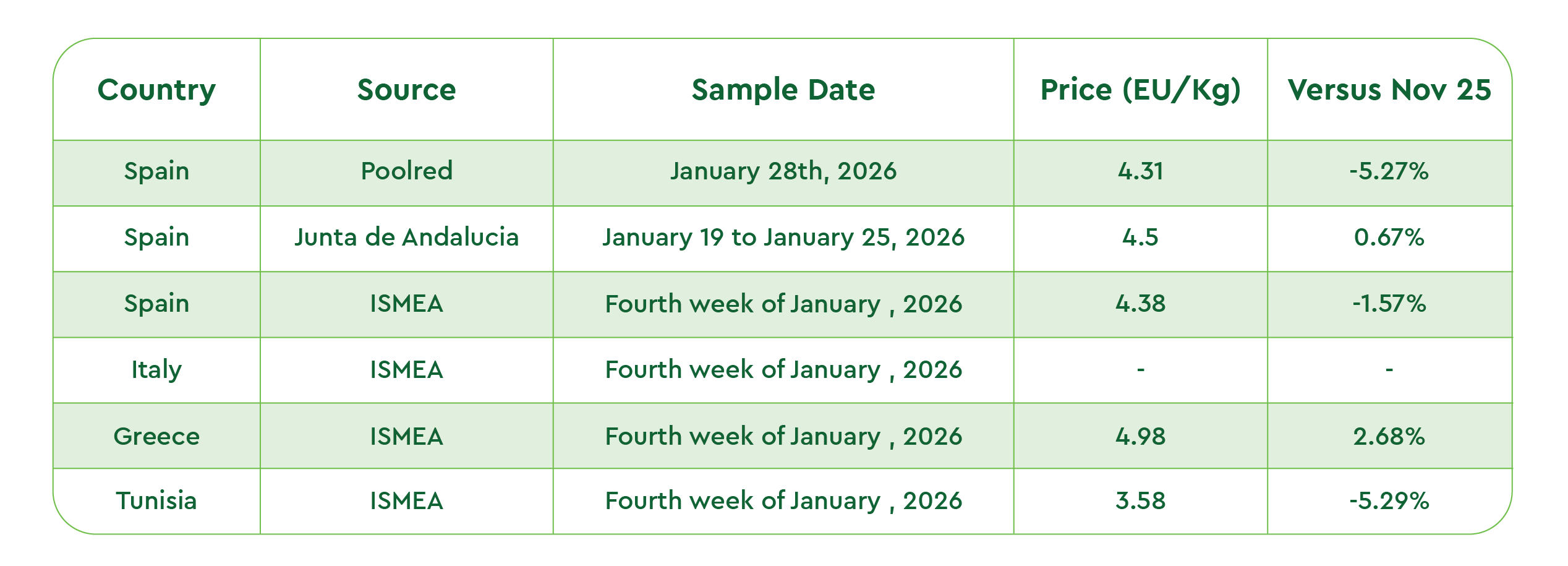

Latest Olive Oil Market Figures from Official Industry Sources

At present, no official prices for EVOO are listed on the ISMEA platform, indicating uncertainty about current market prices.

**Note: Reported prices are averages across multiple quality grades. Premium, traceable, clean, pesticide-free extra virgin olive oil typically trades at higher values.

Extra Virgin Olive Oil Price Evolution

Sources: Poolred, Ismeamercati.

Spanish Volume Balance Sheet: December

In December 2025, Spain produced 416,471 tons of olive oil, 30 % less than in December 2024 (592,570 tons). This decline was mainly due to continuous rainfall, which delayed olive harvesting and prevented producers from working for about two weeks. Overall, cumulative olive oil production for the 2025/26 season now stands at around 716,372 tons.

During December, 92,464 tons were released to the market (domestic consumption plus exports, excluding imports). Sales remained steady despite the public holidays, in line with the previous month’s.

Total stock levels reached 715,735 tons. Of this total, 550,895 tons are held in mills, 160,610 tons with bottlers, and 4,230 tons in public storage (PCO). By comparison, at the end of December 2024, the market had 893,000 tons available, meaning that stock levels in December 2025 were about 24 % lower than the same period last year.

Andalusia’s harvest has been especially difficult this season. In Córdoba, output missed forecasts after rainfall and a later-than-planned picking period slowed operations. In Jaén, persistent rain in November and December, along with limited labor availability, contributed to an estimated 45% year-on-year decline.

A share of the crop has dropped to the ground and is being left uncollected as costs outweigh potential returns. As a result, producers face greater uncertainty, with weaker volumes and rising expenses squeezing margins. Region-wide, cumulative production remains well below initial projections, further straining Spain’s overall supply.

Key Figures of the Olive Oil Market (December) (in Tons)

Global Trade & Policy Snapshot: EU-Mercosur/India Deals, Spanish Controls, Tunisian Quota, US Tariffs, Weak Dollar.

On 17 Jan 2026, the EU and Mercosur (Argentina, Bolivia, Brazil, Paraguay, Uruguay) signed a Partnership Agreement and Interim Trade Agreement, setting a path to phase down tariffs on goods, including agri-food such as olive oil. Ratification and implementation remain pending, subject to review by the European Parliament and the European Court of Justice. On 27 Jan 2026, the EU and India said they had concluded FTA negotiations, under which India’s tariff on EU olive oil (up to 45%) would be reduced to 0% over five years, pending signature and legal ratification.

In Spain, the government announced a tighter official control framework for olive oil and olive-pomace oil from 2026, expanding checks across the supply chain and at borders, with at least 20% of operators covered annually. Aligned with Spain’s National Official Control Plan 2026–2030, the plan will rely on digital traceability tools (SIMO and REMOA), similar to Italy’s SIAN, to monitor stocks and bulk movements and strengthen oversight of imports and internal trade.

For North Africa, EU inflows remain quota-managed: Tunisia’s duty-free quota is around 60,000 tons/year, with volumes above that subject to standard duties. Tunisian stakeholders continue to push for 100,000 tons, and in Italy, the discussion has resurfaced over increasing Tunisia’s duty-free access amid Tunisia’s strong crop and export momentum.

In the US, there is still no binding federal standard of identity for olive oil under FDA rules, so traceability and quality definitions rely mainly on voluntary federal grade standards, state‑level rules, and private certification schemes. A recent bipartisan bill seeks to close this gap by directing the FDA to develop the first federal standard of identity.

The US olive oil market remains structurally import‑dependent, as domestic production, primarily in California, cannot meet consumption; price is the main pressure point for importers and retailers sourcing from the EU and North Africa, with EU olive oil and table olives facing tariffs of up to 15% under the new US–EU framework, Tunisian olive oil subject to a 25% country tariff introduced in 2025, and a weak dollar now adding further cost uncertainty for these import flows.

Global Olive Oil Production Forecast 2025/26: Slight Decline Expected

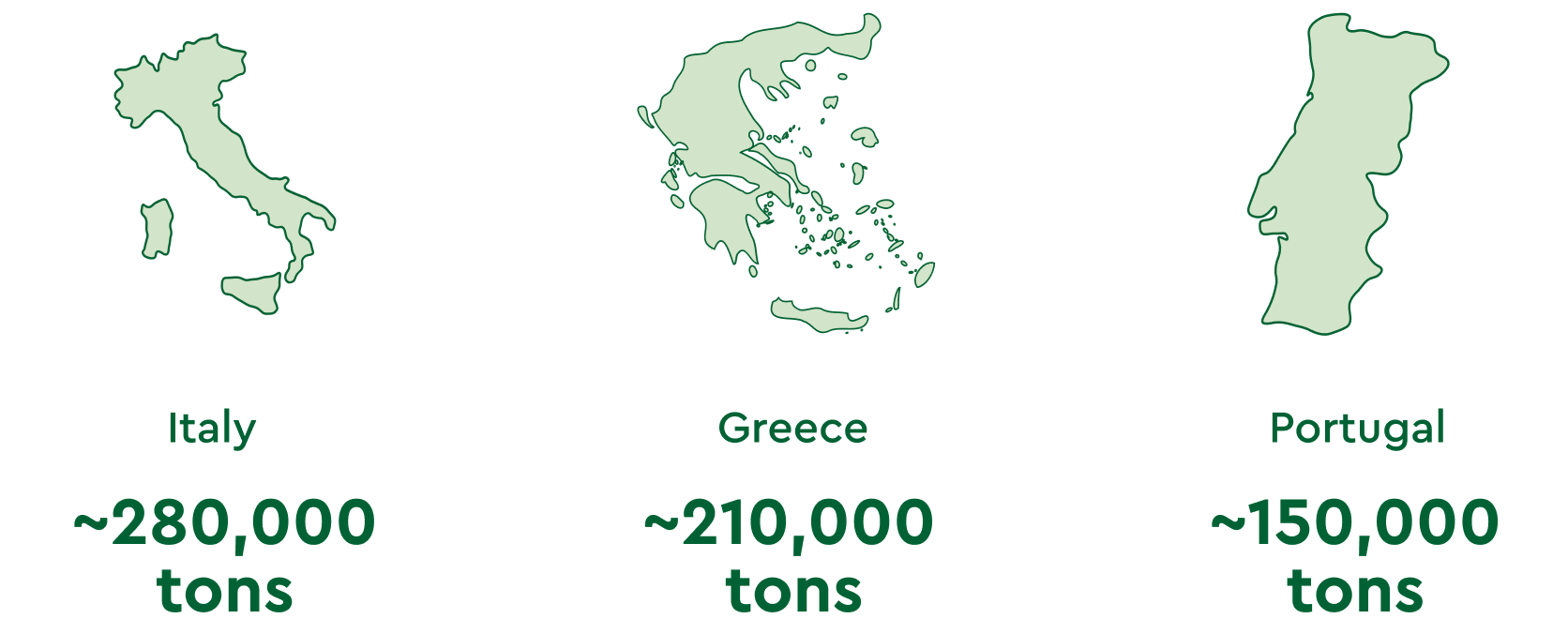

Global olive oil production for 2025/26 is estimated at ~3.44 million tons, about 4% below last season’s levels, according to the latest IOC figures. Output remains relatively high after the strong 2024/25 rebound.

For the EU, the USDA forecasts a modest decline to ~2.055 million tons (from ~2.107 million), still above the five-year average, with heat, drought, and pest pressure weighing on yields. Spain is expected to reach ~1.37 million tons, broadly in line with national estimates: good spring moisture improved crop potential, but summer heat and a dry autumn reduced yields. Regional performance is mixed, with declines expected in parts of Andalusia and Castilla-La Mancha, offset by gains in Extremadura and a sharp rebound in Catalonia.

Italy is forecast at ~300,000 tons, Greece at ~210,000 tons (around -15%), and Portugal at ~150,000 tons. Overall volumes should remain well above the recent historic lows.

On the demand side, EU consumption is projected at ~1.425 million tons, exports at ~765,000 tons, and imports at ~200,000 tons, pointing to a more stable balance after two highly volatile seasons.

Final Thoughts for 2026 Procurement

Despite a relatively solid harvest and buyer expectations that prices will fall below 4.00 Eu/kg, Spanish olive oil values have not yet softened.

As 2026 begins, Spanish operators continue to defend current price levels, citing production down by up to 30% year on year and a recent uptick in demand from both Europe and the United States.

In Andalusia, producer groups such as UPA-Andalucía argue that stable prices are needed for traditional growers to cover rising costs. However, Portuguese EVOO briefly traded below Spanish origin this month, underscoring how lower-priced supply from Portugal and Tunisia could intensify competitive pressure on the world’s largest producer.

Overall, supply concerns appear contained, but there are still no clear signals of a sharp price correction in the near term. Excessive rainfall in Spain is delaying harvesting and weighing on quality and volumes, while potentially supporting soil moisture and improving prospects for the 2026/27 crop.

Looking forward, the current policy backdrop suggests a gradual shift toward a more diversified, multipolar market. If the negotiated tariff reductions in India and Mercosur are implemented, both could emerge as meaningful growth channels for European and Mediterranean producers, encouraging brands and exporters to broaden their focus beyond North America.

In the short term, however, market direction is still largely set by EU production and intra-regional trade conditions, alongside rising demand uncertainty in the US, where Dollar exchange rates and purchasing power could be influencing outcomes as much as supply fundamentals.

Plan your 2026 sourcing now, contact the Certified Origins teams to secure dependable, value-aligned private-label supply programs backed by our production capacity in North America and Europe.