Olive Oil Market Report – April 2024

Plummeting prices from Spain are raising eyebrows in Europe

What’s happening this month?

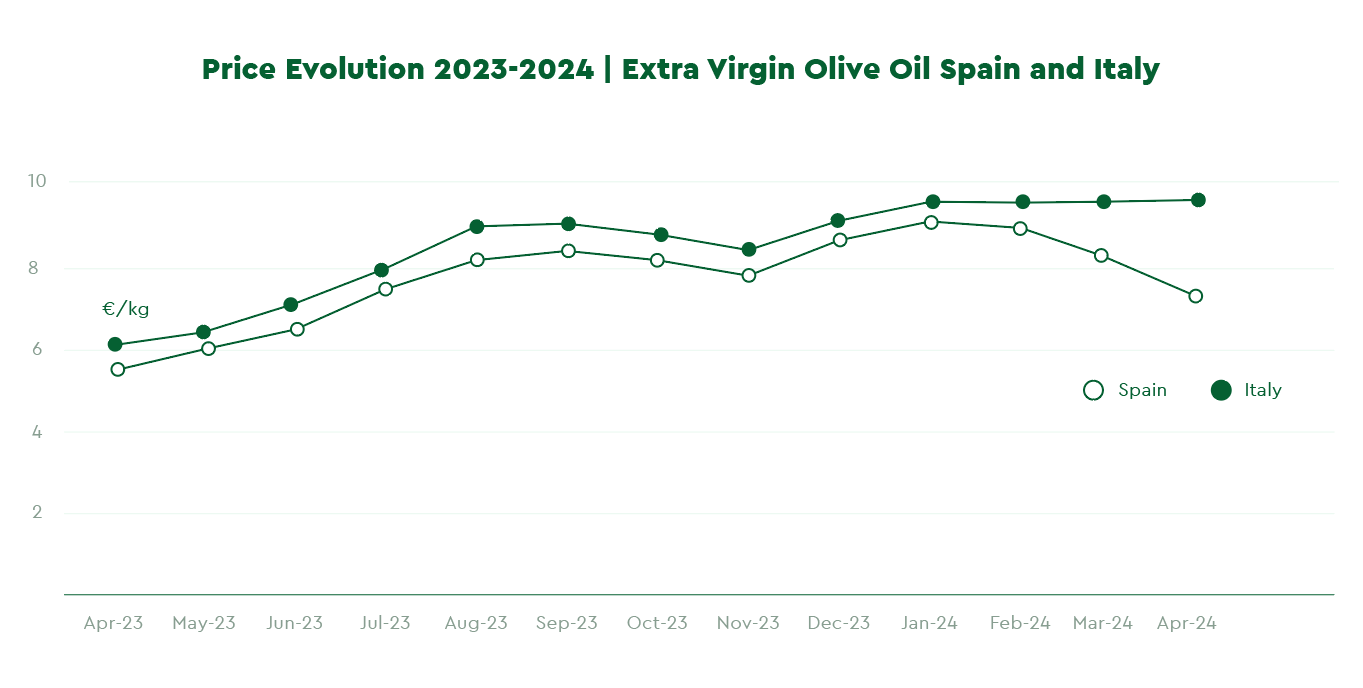

The Spanish price downtrend for all Olive Oil grades continued throughout April, causing a domino effect in the other main markets, with the notable exception of Italy, which seems immune from this sharp change.

The world leader in olive oil production has seen the value of Extra Virgin Olive Oil fall by almost 10% since the beginning of April. Compared to January, when prices climbed to 9 euros per kilogram, prices have decreased by approximately 17% on average.

The long-awaited rain over Easter falling on the Iberian Peninsula, a drop in local consumption that moved Spain from being the second largest consumer of Olive Oil to third position after the USA, and new optimism on future harvest expectations have all contributed to this downturn after an almost interrupted year of historically record-breaking heights for Spanish olive oils.

Among other contributing factors to this trend inversion, we can consider cash liquidity challenges and the approaching need for traders to gradually free their tanks, especially of lower-quality batches, to prepare the room for the new crop.

Many Spanish cooperatives, producers, and mills that held on to their Oil stock in the past months, waiting for prices to grow further, now need cash to pay the farmers for their olives from the just concluded harvest. They are also facing the realistic scenario of seeing the value of their inventory decrease as quickly as it grew in the past several months.

Here is some of the most recent available data, divided by origin, from some of the most reliable trade platforms to track average olive oil prices:

Spain: Eu/Kg → 7.44 – 10 % versus last month, + 37.6% versus price same period 2023 (Poolred)

Italy: Eu/Kg → 9.52 -0.01% versus last month, + 56.2% versus price same period 2023 (Ismea)

Greece: Eu/Kg → 8.68 -1.2% versus last month, + 70.9% versus price same period 2023 (Ismea)

Tunisia: Eu/Kg → 7.85 -5.4% versus last month, + 50.2% versus price same period 2023 (Ismea)

Sources: Poolred, Ismeamercati

The market and demand for quality Extra Virgin Olive Oils have yet to experience sharp drops. Our sourcing team reports a range of 0,50 to 2,00 Eu/Kg premium for higher categories, above trading prices, caused mostly by the below-average quality of the past crop and scarcity of certified and pesticide-free oils suitable for international retail standards.

Worldwide Production and Spain’s Balance

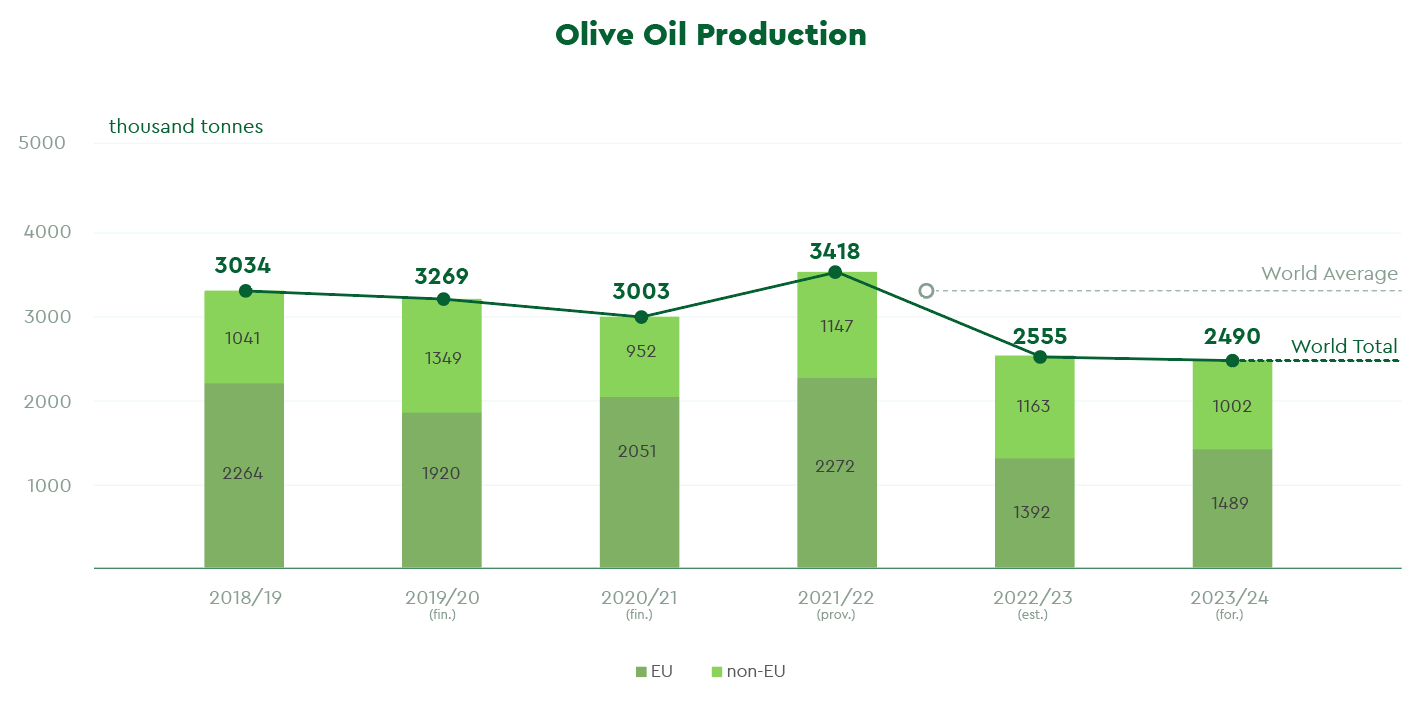

The provisional worldwide numbers for the 2023/24 harvest, published by the European Commission on March 28th, show that although European countries increased production by 19% compared to 2022/23, global production declined for two consecutive years.

Spain’s olive oil stock output figures for March remained elevated: the country released 67,052 Tons in the market, which is close to the average number of 70,000 Tons (without adding the imports for April).

Inventory levels are a cause of concern, as Spain has only 659,285 Tons left six months before the end of the year. Of this, 184,870 Tons are already in the hands of packers and are likely to have been under contract.

With the remaining 470,914 Tons, Spain will most likely enter the new harvest with a substantially low inventory.

Speculation or Market Adjustment: What’s next?

Numerous experts interviewed by magazines and journalists specializing in olive oil trade sectors are raising concerns and questions about the sudden and significant price declines triggered by Spain in the last few weeks.

Some attribute the price fluctuations to natural market dynamics, where supply and demand regulate themselves; others point to the impact of rainfall and rising expectations of a better future harvest after two consecutive negative years.

In an excellent article published by Mercacei, a Spanish trade magazine, some local stakeholders don’t see the weather and the self-regulating dynamic as a justification strong enough to explain the magnitude and the speed at which the EVOO market changed course.

Although some rainfall has raised hopes for the next harvest in the Mediterranean basin, the limited inventory and steady demand for olive oil from international retailers have left many perplexed as to why some actors are suddenly so eager to sell.

Everyone seems to agree that such a significant price drop will create instability throughout the supply chain, uncertainty, a possible loss of patience from global retailers, and a trade imbalance for the coming months.

Final Thoughts

After months of drought, Andalusia, Spain’s key growing region, is finally seeing its water reservoir slowly replenishing at 43% of capacity, above the 29% recorded in 2023 in the same period. Although the current levels are still below the 10-year average of 57%, this development is excellent news for the olive trees, and it increases the potential for a positive harvest in the future. Along with Spain, Greece, Turkey, Portugal, and Tunisia are all looking forward to the 2024/25 season with optimism.

Whichever the reason, market prices in most Mediterranean-producing countries are trending down, driven also by Spanish stakeholders’ moves. Looking at these key events, a return to “normal” dynamics in 2024/25 cannot be ruled out, but first, Spain will have to manage its scarce stocks well enough to make it to the new harvest without running dry.

The upcoming export and consumption trends and climate conditions during the spring flowering period will play a crucial role in the final outcome. For this reason, upward price corrections may happen again.

Despite the challenges, we remain cautiously optimistic and advise our friends and business partners to be alert about the quality and value ratio of oils that are quickly released into the market.

Back to blog