Olive Oil Monthly Report – October 2023

Market prices start to trend down with the new harvest

What’s happening this month?

October marked the start of the Olive harvest season for most producers in the northern hemisphere. Fresh Extra Virgin Olive Oil and Olive Oil volumes are slowly entering the trade market, bringing some calm after a challenging transition phase, where nearly all the major Mediterranean countries reported meager reserves sock, accompanied by demand and prices skyrocketing at unprecedented levels.

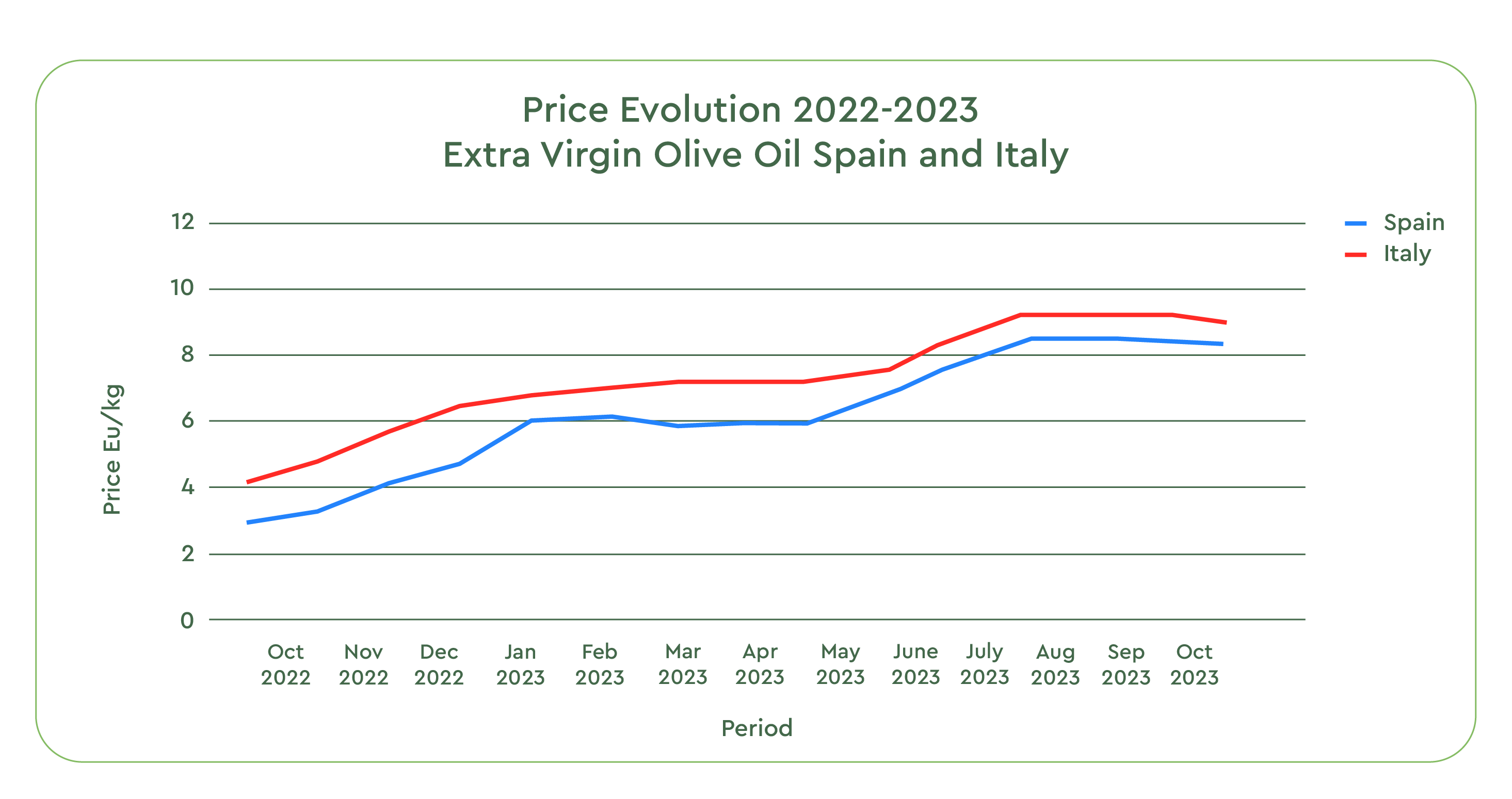

Both Poolred and ISMEA, respectively, Spanish and Italian organizations tracking prices and trends for food commodities, started to observe slight decreases in the average traded value for Extra Virgin Olive Oil and other quality grades.

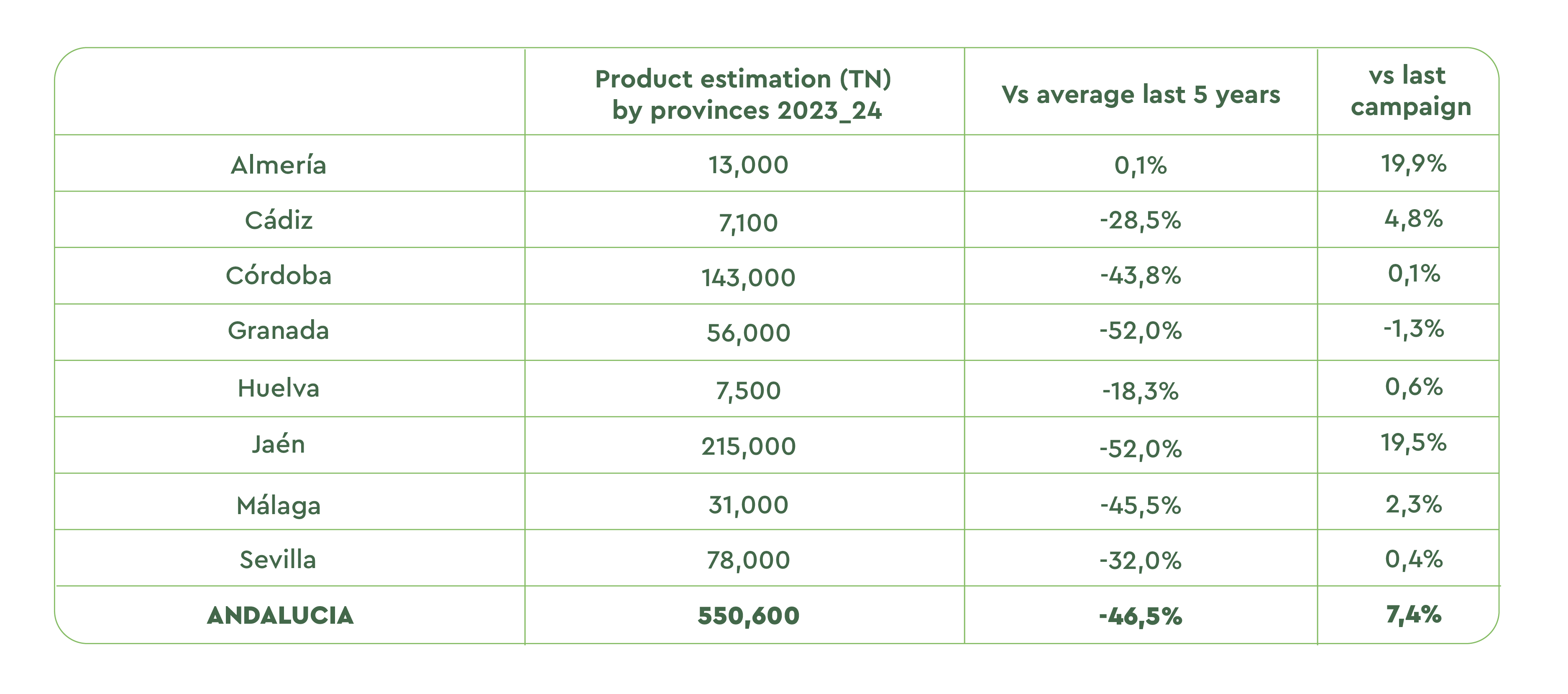

The “Junta Andaluzia” association, monitoring some of the world’s largest olive oil production areas, published its annual report, projecting a slight increase in Andalusia, in the south of Spain, compared to last season. Their numbers are, however, painting a very similar picture to the 2022/23 crop, with volumes well below historical averages and confirming a far from positive outlook for Spanish farmers and global actors in the Olive Oil supply chain.

The South of Italy is responsible for approximately 70% of the National production from the peninsula, the Puglia region being the most significant contributor, followed by Sicily and Calabria. Unfortunately, recent hail and flash floods damaged the Puglia region’s crops, decreasing the Italian initially optimistic forecasts and intensifying the attention of traders and farmers on yield data and quality analysis from the Italian cooperatives and mills.

MARKET OVERVIEW FOR EVOO

Companies, brokers, and producers slowly withdrew from the market in August and September, driven away by the scarce quantities, average quality, and exceptionally high prices. The availability of fresh olive oil has inverted the trend since the beginning of this month. International and local buyers are eyeing new opportunities and hoping Europe’s announced autumn rain season will further ease the market.

While Poolred reported an average price of 8.45 Eu/Kg in September for Spanish Extra Virgin Olive Oil, prices decreased to 8.15 Eu/Kg in the first week of October—a trend shared by the other grades, Lampante and Virgin Oil.

ISMEA reports a price decrease of approximately 4 % versus prices in September for Italian Extra Virgin Oil (8.78 Eu/Kg), while prices for Greece and Tunisian Extra Virgin Oil remain stable.

However, according to our sourcing teams, these lower evaluations refer mainly to oils from last year, released from storage to make space for the new production, to avoid declassification and quality problems, especially for Extra virgin Olives, degrading over time by their natural aging process. The new oils maintain sustained prices, in line with the previous months.

Spain expects a slight production increase

According to the Spanish Ministry of Agriculture, Fisheries and Food, the ongoing olive oil harvest could deliver 765,400 Tons. Even if this figure represents an increase of 15% from last year, it is still well below Spain’s full potential and historical averages.

The annual report by Junta Andaluz, released this month, updated the projections for Andalusia, Spain’s leading production area for Olive Oil, to 550,600 Tons. Should it become real, this number would mean an increase of 7% compared to 2022/23, but still 40% below the average of the last 4 four crop years.

The meager remaining carry-over inventory of approximately 257,000 Tons (43,4% below last year), is also a piece of essential information to take into consideration. Both elements will undoubtedly influence the domestic and international markets.

The current projection for Spanish Organic Evoo production is 14,200 Tons. Córdoba, with 5,600 Tons, will be the leading producing province for this category. This value is almost identical to the 14,102 Tons from last year, with a slight +0.7% increase, which is still good news, considering last year’s sharp 51% drop below average.

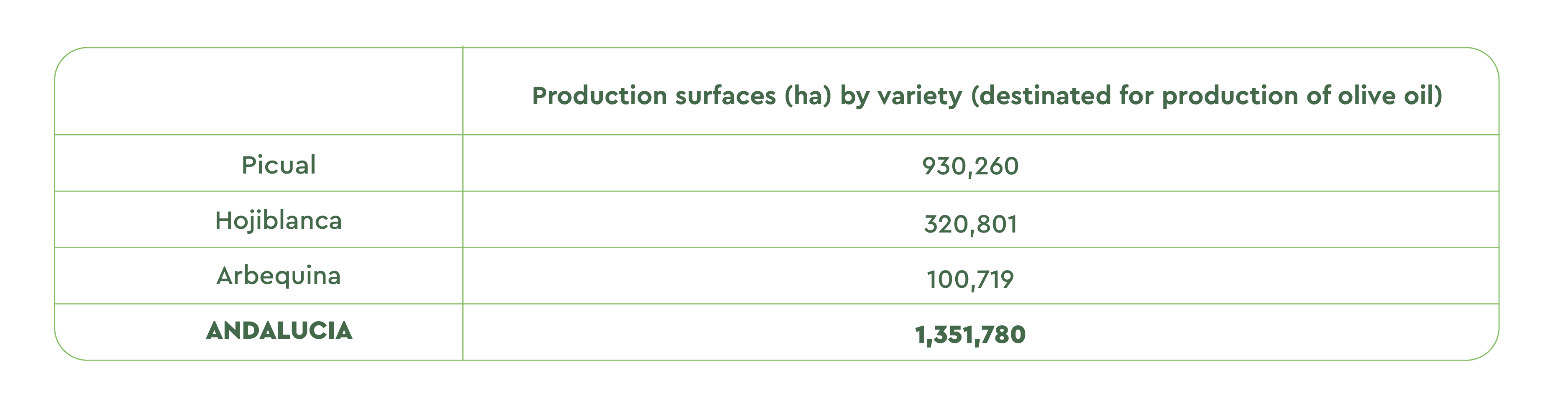

The hectares dedicated to Organic olive farming have increased over the previous ten years by 62,437 ha and now represent a total surface of 117,237 ha, approximately 7.5% of the whole surface of olive groves in Andalusia.

This chart shows Spanish estimates by region and olive variety.

A. Estimates by region:

B. Estimates by variety:

C. Estimates by surface (HA):

Italy and other Mediterranean Countries

In the north of Puglia, thunderstorms, rain, and hail damaged the olive groves and their crops just before the beginning of the harvest season. Farmers described the storms as catastrophic, with some saying they lost their entire crops. The full extent of these extreme weather events is yet to be fully understood.

Puglia is traditionally the most significant contributor to Italian Extra Virgin Olive Oil production. Although other Italian regions, like Sicily, report healthy fruits, the 23/24 crop will probably fall from 300,000 Tons to 270,000 – 280,000 Tons: an increase of approximately 20% compared to last year but still 16% below the four previous crop’s average. Similarly to Italy, Greece, Morocco, and Turkey, producers are also lowering the projections for 23/24 crop (approximately 180,000 Tons for Greece, 100,000 Tons for Morocco, and 190,000 Tons for Turkey). Tunisia is a positive exception, with a forecasted growth of 10 to 15% in volumes, most of which are of good quality and compatible with an organic certification.

Final Thoughts

Prices at the origin may have peaked in September. Still, the cost has improved only for transactions involving old inventory: a common phenomenon for this period of the year, as producers make space for the new crop. We will have to wait until next month to see if this trend continues and will extend to the newly available volumes.

Further rainfalls are expected in October and November, offering relief from a hot and dry summer in the Mediterranean area. Yet too much rain or extreme weather events could damage the fruits or slow the harvest operations.

Even if Spanish forecasts for the current harvest are slightly better than last year, the overall picture offers few opportunities for optimism and expectations of a return to normality. Challenges such as weather, inflation, and global political uncertainty are still on the table and will continue to influence, preoccupy, and stress the markets.

We recommend to our business partners and friends to exercise caution, constantly monitoring the markets for windows of opportunity. Don’t hesitate to reach out and talk with our team of experts and share any question or comment you may have.

Sources:

Spanish Ministry of Agriculture

Aforo de Producción de olivar en Andalucía Campaña 2023-2024

Olive Oil Time

Olimerca

Teatro Naturale

Poolred

Ismea